Asset Liability Management - Online Course

About the Course

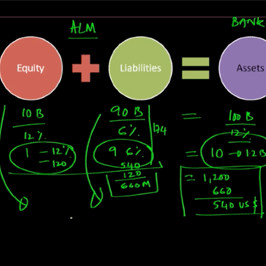

The course begins with a definition of asset liability management and associated interest rate and liquidity risks and other measures such as duration, convexity, volatility, asset and liability sensitivity and Value at Risk. It presents the core steps for building an ALM model and explains how the model links balance sheet and P&L items to a valuation model, an interest rate generator and calculation engine to generate a number of ALM reports that are presented to the Board of Directors (BOD) and management.

Next exposure, risk and target accounts and the various parts of an ALM framework which have an impact on shareholder value and income are discussed. This is followed by a detailed walkthrough on how Fall in Market Value of Equity, Earnings at Risk, Cost to Close, Rate Sensitive Gap, Duration Gap are calculated. An overview of other ALM reports such as price sensitive gap, net interest income (NII) and liquidity gap is given. The results from the various reports are discussed and compared. Applications for explaining immunization and portfolio dedication are presented.

The course concludes with a discussion of liquidity risk management measures including ratios and analyses for measuring liquidity risk, limits for managing the risk, general and specific requirements for developing a contingency funding plan and liquidity enhancement tactics for company specific and systemic crisis.

Learning Objectives

After taking this course you will be able to:

- Define Asset Liability management (ALM)

- Define the various risks associated with ALM

- Explain the core steps for building an ALM model

- Define some important terminology and concepts related to ALM

- Summarize how to calculate Value at Risk (VaR)

- Outline the elements of an ALM Framework

- Compute the fall in market value of equity due to non-parallel VaR based interest rate shocks

- Evaluate earnings at risk due to non-parallel VaR based interest rate shocks

- Calculate a number of other ALM measurement tools and reports such as cost to close, rate sensitive, price sensitive, liquidity and duration gaps, & net interest income (NII) report

- Demonstrate some examples of ALM risk and applications of management and measurement tools

- List liquidity ratios used for measuring and managing liquidity risk

- Describe various limits used to manage liquidity risk

- Discuss the requirements for setting up a contingency funding plan

- State some liquidity enhancement tactics to manage a liquidity crisis situation

Course Details | ||||

| Level | Intermediate | |||

| Prerequisites | The candidate should have familiarity with the calculation of Value-at-Risk (VaR), local markets, portfolio management and the Basel II/III framework. They should also be comfortable with basic mathematics, statistics, probability and EXCEL. | |||

| Target Audience | The course is aimed primarily at banking professionals and individuals responsible for asset liability management and risk management within banks, insurance companies and mutual funds who need to review or refresh their understanding of ALM and Capital Adequacy regulations for work, professional review, audit or personal development. | |||

| Advance Preparation | None | |||

| Minimum Browser Requirements | This site is best viewed in Google Chrome, Firefox or Safari. Please note we do not support Internet Explorer. | |||

| Course Guide | This course consists of five lessons:

| |||

| Course Availability | Online subscription is for a 60 day period only. This content will not be available after the period ends. | |||

Sample Video Content