Credit products

Credit Default Swaps

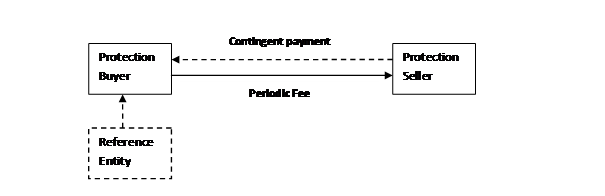

This swap transfers the credit risk of fixed income products, like municipal bonds, mortgage backed securities and corporate debt between two parties. The buyer of the credit swap receives credit protection against default, a credit rating downgrade or any other negative credit event. The seller of the product assumes the risk and in return received a period payment. The contract references an underlying fixed income instrument which is known as a “reference entity”. In the event that the negative credit event occurs the seller will be obligated to deliver either the current cash value of the referenced bonds or the actual bonds to the buyer depending on the terms of the contract.

| Sample term sheet for a credit default swap traded by XYZ Bank plc Draft Terms – Credit Default Swap |

|

| 1. General Terms | |

| Trade Date | Aug 5, 2003 |

| Effective Date | Aug 6, 2003 |

| Scheduled Termination Date | Jul 30, 2005 |

| Floating Rate Payer (‘Seller’) | XYZ Bank plc, London branch |

| Fixed Rate Payer (‘Buyer’) | ABC Investment Bank plc |

| Calculation Agent | Seller |

| Calculation Agent City | New York |

| Business Day | New York |

| Business Day Convention | Following |

| Reference Entity | Jackfruit Records Corporation |

| Reference Obligation | Primary Obligor: Jackfruit Records |

| Maturity | Jun 30, 2020 |

| Coupon | 0% |

| CUSIP/ISIN | xxxxx |

| Original Issue Amount | USD 100,000,000 |

| Reference Price | 100% |

| All Guarantees | Not Applicable |

| 2. Fixed Payments | |

| Fixed Rate Payer | |

| Calculation Amount | USD 7,000,000 |

| Fixed Rate | 0.3% per annum |

| Fixed Rate Payer Payment Date(s) | Oct 30, Jan 30, Apr 30, Jul 30, starting Oct 30, 2003 |

| Fixed Rate Day Count Fraction | Actual/360 |

| 3. Floating Payments | |

| Floating Rate Payer | |

| Calculation Amount | USD 7,000,000 |

| Conditions to Payment | Credit Event Notice (Notifying Parties: Buyer or Seller) Notice of Publicly Available Information: Applicable (Public Source: Standard Public Sources. Specified Number: Two) |

| Credit Events | Bankruptcy, Failure to Pay (Grace Period Extension: Not Applicable. Payment Requirement: $1,000,000) |

| Obligation(s) | Borrowed Money |

| 4. Settlement Terms | |

| Settlement Method | Physical Settlement |

| Settlement Currency | The currency in which the Floating Rate Payer Calculation Amount is denominated |

| Terms Relating to Physical Settlement | |

| Physical Settlement Period | The longest of the number of business days for settlement in accordance with the then-current market practice of any Deliverable Obligation being Delivered in the Portfolio, as determined by the Calculation Agent, after consultation with the parties, but in no event shall be more than 30 days |

| Portfolio | Exclude Accrued Interest |

| Deliverable Obligations | Bond or Loan |

| Deliverable Obligation Characteristics |

|

| Restructuring Maturity Limitation | Not Applicable |

| Partial Cash Settlement of Loans | Not Applicable |

| Partial Cash Settlement of Assignable Loans | Not Applicable |

| Escrow | Applicable |

| 5. Documentation Confirmation to be prepared by the Seller and agreed to by the Buyer. The definitions and provisions contained in the 2003 ISDA Credit Derivatives Definitions, as published by the International Swaps and Derivatives Association, Inc., as supplemented by the May 2003 Supplement, to the 2003 ISDA Credit Derivatives Definitions (together, the ‘Credit Derivatives Definitions’), are incorporated into the Confirmation |

|

| 6. Notice and Account Details Telephone, Telex and/or Buyer: Facsimile Numbers and Phone: Contact Details for Notices Fax: Seller: A.N. Other Phone: +1 212-xxx-xxxx Fax: +1 212-xxx-xxxx Account Details of Seller 84-7512562-85 Risks and Characteristics Credit Risk. An investor’s ability to collect any premium will depend on the ability of XYZ Bank plc to pay. Non-Marketability. Swaps are not registered instruments and they do not trade on any exchange. It may be impossible for the transactor in a swap to transfer the obligations under the swap to another holder. Swaps are customised instruments and there is no central source to obtain prices from other dealers. |

|

Total Return Swaps

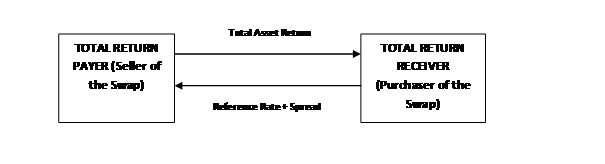

A swap agreement in which one party makes payments based on a set rate, either fixed or floating, while the other party makes payments based on the return of an underlying asset, which includes both the income it generates and any capital gains. In total return swaps, the underlying asset, referred to as the reference asset, is usually an equity index, loans, or bonds.

The Total Return Swap allows the user to accept the economic benefits of asset ownership without utilizing the balance sheet. The other leg of the swap, usually LIBOR, is spread to reflect he non-balance sheet nature of the product. A Total Return Swap can be designed with any underlying asset agreed between two parties. No notional amounts are exchanged with the swap. The total return payer is the legal owner of the reference asset.

The total return receiver may also be required to post initial collateral as well as marginal collateral in the event that the market price of the collateral declines.

A key element of a total return swap is that both the market risk and the credit risk of the underlying asset is transferred.

| Reference Asset Details | |

| Reference Party: | Sinclair Broadcast Group |

| Facility Type: | Bond |

| Notional Amount: | USD 10 million |

| Facility Maturity Date: | 15th July 2007 |

| Coupon Rate | 9% |

| Swap Details | |

| Initial Price of Reference Asset: | 102% |

| Swap Counterparty: | Bank ABC |

| Trade Date: | 5th August 2002 |

| Swap Termination Date: | 8th August 2005 |

| Swap Amount: | USD 10 million |

| Settlements: | Semi-Annual |

| Reference Rate: | 6-month LIBOR |

| Deal Spread | 0.85% |

| Initial Collateral: | An amount of cash equal to 10% of the swap funded amount |

| Marginal Collateral: | Cash collateral by the swap receiver to the swap payer. Greater of Reference Asset Initial Price minus the Market Price, and zero |

Collateralized Debt Obligation (CDO)

A CDO is a debt security collateralized by a variety of debt obligations including bonds and loans of different maturities and credit quality. It is designed to give protection against losses in a portfolio. Returns on the CDOs are paid in tranches. Each tranche has a different maturity and risk associated with it. The higher the risk is the more the CDO will pay the protection buyer.

There are two types of cash flows in this instrument. Periodic premiums are paid by the protection buyer to the seller. There may also be an upfront premium. In return the buyer will received the amount of loss suffered by the tranche that he has acquired.

Comments are closed.