The third part of the Big Short Case Study. This post traces the origin of the mortgaged backed CMO CDO CDS product sets referenced in the book and the film. The terms stand for Collateralize Mortgage Obligation (CMO), Collateralize Debt Obligation (CDO) and Credit Default Swap (CDS).

From home loans to CMO

A family buys a home using a mortgage loan from a bank. They enter into an agreement to pay monthly interest and principal payments for the next 20 to 30 years. The most common of these loans is a fixed rate loan. This loan locks the bank and the family into a fixed interest rate for the duration of the loan. Banks allow partial and full prepayments if the family meets certain conditions.

To release capital and cash locked into the loan the bank collects a pool of similar loans. Similar loans eligible for a pool could match on a number of attributes:

- loan amount,

- property type,

- geographical location,

- contributed equity, and

- credit scores of borrowers.

The bank sells the pool of loans to a Special Purpose Vehicle (SPV) that buys and houses them. Investors of the SPV fund and finance the sale. The SPV sells ownership interests to investors. The investors essentially buy the right to receive monthly interest and principal payments from the pool in proportion to their ownership percentage.

From Mortgages to CMO – The Challenge

As the benchmark interest rates rise or fall the principal prepayments on mortgages also move up and down. As rates rise the rate of prepayments declines because home owners have no incentive to refinance. When rates fall, the rate of prepayment increases as the incentive to refinance increases.

The word refinance here refers to the opportunity to take out a new loan at lower interest rates and lower monthly payments. For instance, for a homeowner with a 30 year 200,000 loan on a 250,000 townhouse, monthly interest payments at 7% turn out to be $1,331. If the benchmark rate falls to 4%, the loan will refinance and payments will reduce to $954. That is a saving of 376 every month. Even after including the cost of closing fees for the new loan the transaction pays for itself in less than a year.

For investors in the pool, this presents a challenge. An investor may have bought a mortgage backed security with an investment horizon of 15 – 20 years. If interest rates decline significantly he may actually be prepaid much earlier than expected. More importantly, he would then have to reinvest at the significantly lower rates in place now. So, in essence, a double whammy. Earlier than expected return of principle and reinvestment of the amount at lower interest rates.

CMO – The Solution

To handle this challenge banks came up with a solution. While all shares of the SPV were created equally in terms of ownership interest, they would now be segregated in terms of the order in which principal payments would be received.

Each unit of ownership interest is placed in a tier. Each tier is called a tranche. The lowest tiers would receive all principal repayments first. Only when they are completely paid off would the repayments flow to the higher tiers. Using this approach it was possible to defer the impact of prepayments on the highest tiers. To cover the increased risk of earlier payments, the lower tiers would receive a higher rate of interest and the highest tiers would receive a correspondingly lower rate.

While prepayments would still impact maturity dates, the highest tranches could now receive some reassurance that they would not be immediately impacted by the flood of repayments triggered by lower interest rates.

Investor Reactions

What this did was partially address the repayment problem. Mortgage principal repayment would still occur but at least there was now a structure in place that would add some order and predictability to what was previously a somewhat random occurrence. This new structure is named Collateralized Mortgaged Obligation or CMO for short. For investors interested in maturity the higher tranches promised the most extended maturity possible on a mortgaged backed product. For investors interested in higher returns the lower tranches would promise slightly higher compensation for taking on the additional early prepayment risk.

Defaults and CDO – From CMO to CDO

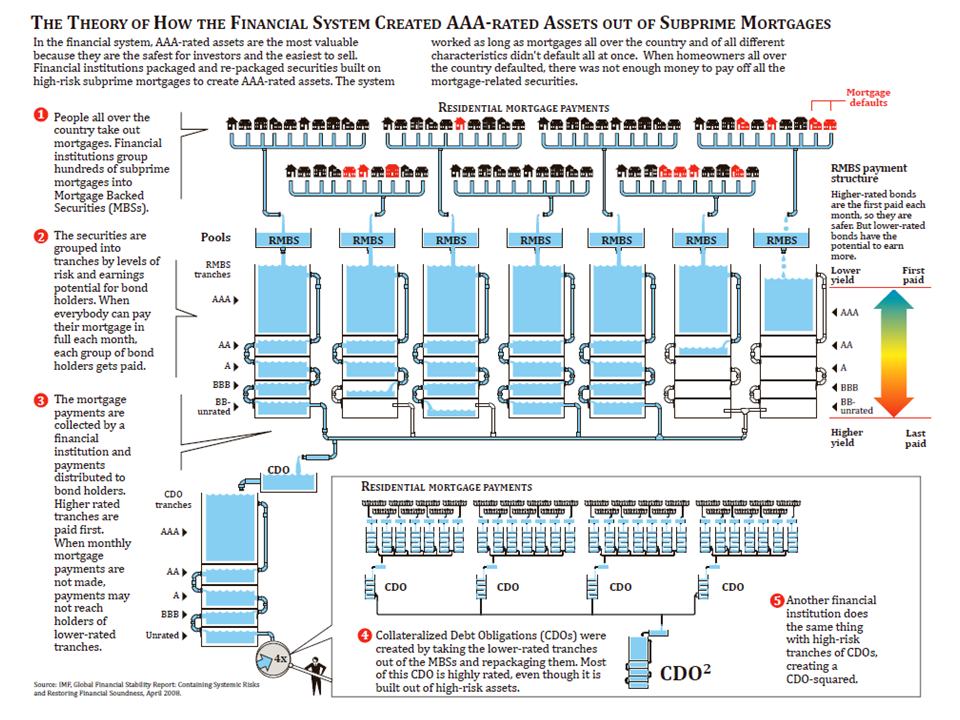

It didn’t take long to apply the idea to credit defaults. Its the same concept but rather than prepayments, this time the segregation applies to loan defaults. As loan defaults occur they first hit lower tranches. Only when a lower tranche is completely wiped out will default impact a higher tranche. This way the highest tranches would receive extra protection against default and a lower interest rate while the lower tranches would take on higher credit risk and receive higher compensation in terms of higher interest rates. This new innovative structure was labeled the CDO – a short form for Collateralized Debt Obligations

Embellishments

For investors, the higher, more secured tranches were obviously very attractive. It was the lower tranches where the marketability issues arose. It was usual for some of the lower tranches within an issue to remain unsold as investors picked the most attractive tranches and left the unattractive ones.

In the securitization world, many tools were used to enhance the appeal of these riskier tranches for investors. The first was over collateralization. Secure one hundred dollars of notional loans with one hundred and ten dollars of collateral. One was sharing in first loss to ensure that the issuer had incentives to maintain some quality in the selection of mortgages within the CDO. The third was providing some level of insurance, backing or conditional support from a strong insurance provider. The fourth was to use some combination of the three to get the credit rating agencies to rate the issue at a higher credit rating.

If one could get a reputable, dependable insurance company with sufficient capital to back an issue with a credit guarantee, the rating agencies would look to the amount of capital available to back that guarantee. Enter AIG FP and Credit Default Swaps.

Credit Default Swaps or CDS

This is how a credit default swap work. An investor would buy default protection against a reference security. The transaction would require the insurer to pay an annual premium payment every year. The insurer would also assume the risk of default on the reference security. In case of a default event on the insured security he would simply surrender the instrument to the insurer and the insurer would make him whole. Making him whole meant that the insurer would simply pay him the notional amount. What the insurer would ultimately recover on the loan would be the insurer’s problem and would no longer be the investor’s concern.

In the beginning, CDS were written on solid corporate credit. But as issuances rose higher and insurance demand for this type of instrument increased, the quality of underlying credit began to fall in later years.