Anti Money Laundering and FATF Review - Online Course

About the Course

The course begins with by presenting an overview of the anti-money laundering (AML) and countering the financing of terror (CFT) compliance regimes. The definition and stages of money laundering are discussed. Examples of compliance violations and penalties imposed by regulators are presented.

This is followed by a case study of an AML/ CFT compliance failure by Habib Bank Limited’s New York branch. We look at the subsequent penalty imposed on it by the New York State’s Department of Financial Services and the resulting implications for the bank.

The 40 FATF Recommendations for Combating Money Laundering and the Financing of Terrorism and Proliferation are summarized. These recommendations provide guidelines and global standards for implementing laws, regulations and frameworks for combating ML/ TF risks. This is followed by a look at FATF’s review process including its technical compliance and effectiveness components and how countries are assigned to the published grey and black lists. A case study walks through Pakistan’s experience, the steps that are needed for it to exit the grey list and the consequences if inadequate action is taken.

Next, the risks that’s designated non-financial businesses and professions (DNFBPs) are exposed to, are explored. This includes a study of the FATF recommendations pertinent to them and a comparison of the degree compliance between financial entities and DNFBPs.

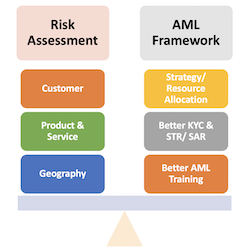

Finally, the features and elements of an effective AML governance framework and monitoring & reporting system are presented. .

Learning Objectives

After taking this course you will be able to:

- Define money laundering and the three stages in the laundering process

- Describe the evolution of the global AML/ CFT compliance regimes

- Review the historical sanctions and penalties imposed for AML/ CFT compliance violations

- Present the time line of events for Habib Bank Limited and its New York Branches $225 million fine for BSA/ AML compliance violations

- Outline the nature of the violations committed over time and the corrective actions required

- Discuss the financial impact and operational challenges post the sanctions

- List the 40 FATF recommendations for developing and implementing effective AML/CFT compliance systems

- Understand the FATF review process and how countries are added to or removed from its published statements for jurisdictions with strategic deficiencies

- Present the time line of events pre & post Pakistan’s inclusion on the grey list

- Explain why DNFBPs pose significant ML/ TF risks

- List the FATF Recommendations that deal with DNFBPs

- Compare compliance regimes for FIs and DNFBPs with respect to supervision & regulation & customer due diligence

- Describe the components of an AML governance system

- Briefly explain the risk assessment process of a risk based AML/ CFT compliance program

- List the features of an effective AML/ CFT monitoring and reporting system

- Discuss what helps and hinders the AML/ CFT monitoring and reporting system

- List the types of reports generated by the system

- Outline the major considerations of a customer risk assessment system

- Describe a customer risk profile scoring system

Course Details | ||||

| Level | Basic | |||

| Prerequisites | None | |||

| Target Audience | AML teams at banks and other financial institutions, and anybody involved in the processing of cross border financial transactions. | |||

| Advance Preparation | None | |||

| Minimum Browser Requirements | This site is best viewed in Google Chrome, Firefox or Safari. Please note we do not support Internet Explorer. | |||

| Course Guide | This course consists of six lessons:

| |||

| Course Availability | Online subscription is for a 60 day period only. This content will not be available after the period ends. | |||