Calculating Value at Risk - Online Course

About the Course

The course begins with a quick review of the various Value at Risk (VaR) calculation methods before moving on to a step by step calculation of VaR under the Variance Covariance (VCV) & Historical Simulation approaches for a simple portfolio of securities. The limitations and related caveats pertaining to the use of this risk metric are then discussed. This is followed by a more comprehensive walkthrough of how VaR may be calculated in EXCEL using the VCV, Historical Simulation and Monte Carlo simulation approaches. A comparison and discussion of the uses of other VaR related metrics such as Incremental VaR (IVAR), Marginal VaR, Conditional VaR and Probability of Shortfall are also covered. The course concludes with applications of VaR in non-traditional areas. Three case studies demonstrate the use of VaR in forecasting the margin shortfall problem within the oil, gas and petrochemical industry; in estimating price shocks for jet fuel & shortfalls in profit margins; and in determining margin requirements for hedge funds in prime brokerage together with estimating their probabilities of default (PDs) and losses given default (LGDs).

Learning Objectives

After taking this course you will be able to:

- Define and interpret Value at Risk

- List the features of and differences between the various VaR approaches- Variance Covariance, Historical Simulation and Monte Carlo Simulation

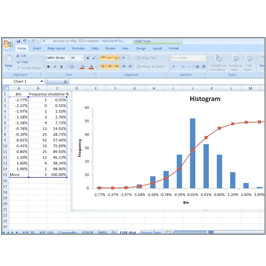

- Calculate VaR under these different approaches in EXCEL

- Calculate Portfolio VaR using the short cut approach as well as the VCV matrix approach

- Differentiate between Rate VaR and Price VaR for fixed income securities

- Identify the limitations of and qualifications to using the VaR measure

- Define and calculate VaR related risk metrics, such as Incremental VaR, Marginal VaR, Conditional VaR and Probability of Shortfall

- Apply the VaR calculations in various real-world case-studies such as calculating input/output price change impacts on profitability, determining margin requirements, evaluating hedge effectiveness.

Course Details | ||||

| Level | Intermediate | |||

| Prerequisites | The candidate should be comfortable with basic mathematics, statistics, probability and EXCEL and some familiarity with markets and portfolio management. | |||

| Target Audience | The course is targeted towards intermediate and advanced users and is aimed primarily at individuals responsible for capital allocation, limit setting and risk management within banks, insurance companies, mutual funds, as well as finance departments of non-financial organizations who need to quickly review or refresh their understanding of VaR methodologies for work or professional development. | |||

| Advance Preparation | None | |||

| Minimum Browser Requirements | This site is best viewed in Google Chrome, Firefox or Safari. Please note we do not support Internet Explorer. | |||

| Course Guide | This course consists of six lessons:

| |||

| Course Availability | Online subscription is for a 60 day period only. This content will not be available after the period ends. | |||

Sample Video Content