Understanding N(d1) & N(d2) - Online Course

About the Course

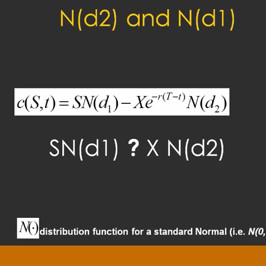

The Understanding N(d1) and N(d2) course is a video based online course that provides a theoretical and practical overview of the risk-adjusted probabilities of the Black-Scholes option pricing formula. The theoretical overview considers the various elements underlying the Black Scholes European call option formula, whereas the practical application involves the creation of a Monte Carlo simulation based model in EXCEL to further clarify these concepts. The course includes a high level overview of Monte Carlo Simulation, an intuitive derivation of N(d2), review of an excel simulation that shows the difference between N(d1) and N(d2) and the first steps required to price an Option using Monte Carlo Simulation in EXCEL.

Learning objectives

After taking this course you will be able to:

- Describe the generator function

- Define and elaborate on drift, diffusion & volatility drag

- Construct a basic Monte Carlo simulator in EXCEL to determine possible future price paths for equities, commodities or currencies

- Identify the purpose and use of the Monte Carlo simulator, i.e. what are the drivers? What is the economic impact?

- Derive N(d2) i.e. the probability that the price at time t, St is greater than or equal to the strike price, X

- State the Black Scholes formula for a European call option

- Explain risk neutrality

- Outline the difference between N(d1) & N(d2)

- Explain and analyze Black Scholes risk adjusted probabilities using a Monte Carlo simulation model for a European Call Option

Course Details | ||||

| Level | Advanced | |||

| Prerequisites | Comfortable with basic mathematics, statistics, probability and EXCEL and some familiarity with derivative products and pricing. | |||

| Target Audience | The course is targeted at basic and intermediate users and is aimed at individuals who deal with pricing, valuation and risk issues related to structured fixed income and foreign exchange transactions. | |||

| Advance Preparation | None | |||

| Minimum Browser Requirements | This site is best viewed in Google Chrome, Firefox or Safari. Please note we do not support Internet Explorer. | |||

| Course Guide | This course consists of seven lessons:

| |||

| Course Availability | Free - Username and Password are provided in the attached text file. | |||

Sample Video Content