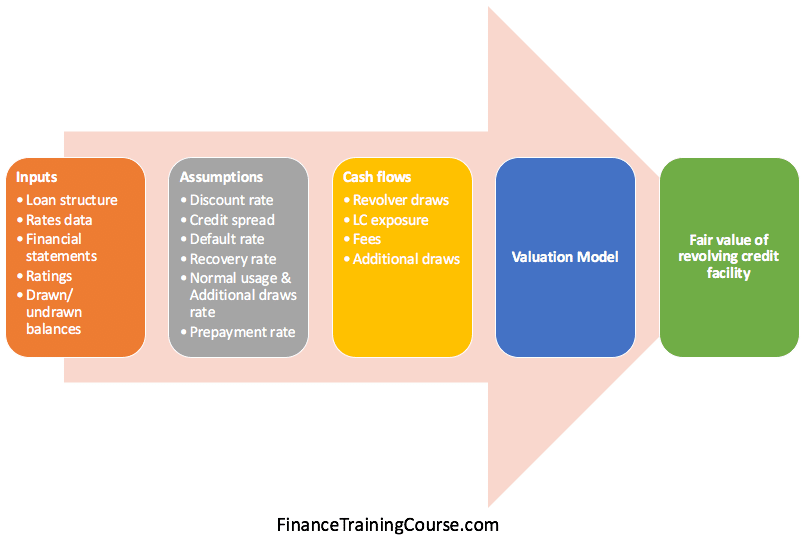

In this post we outline the framework for determining FAS 157 fair values for revolving credit facilities.

Companies avail revolving credit facilities for a number of different reasons. For operating lines, back up lines, to reimburse letters of credit (LC) issued to subsidiaries, etc.

This is an aggregate commitment amount that the company draws against in part or full during the life of the facility. The borrower has the right to choose when to draw the amount and when to pay back the loan during the available period. The revolving credit facilities may be subject to a number of transaction costs. Including a commitment fee on the undrawn portion of the facility, a participation fee on the LC exposure, a penalty fee if the loan is prepaid before the end of an interest payment period.

The loan is also subject to the risk of default of the borrower. Usually, in the period prior to default, revolver draws may increase above the normal anticipated rate of the borrower, as credit in the market becomes more expensive.

While a number of elements in the valuation process are similar to those mentioned earlier for Term B loans there are some significant differences.

1. Inputs for the FAS 157 fair value of revolving credit facility model

Loan structure for a revolving credit facility

The credit agreement will contain details of the total loan amount, start and maturity dates, types of borrowings offered (e.g. base rate or Eurodollar rate loans), the frequency of interest payments, fees payable if any, applicable margins applied to variable interest rates, etc.

Rates data

We use a risk free term structure, such as the US Treasury Daily yield rates both for determining discount rates and calculating future cash flows.

Also, obtain historical time series data for the other reference rates mentioned in the agreement. Data may be available from a number of public domain sources, or you may obtain it from the client. This data will provide an estimate of the average spread of these rates over the US Treasury rates.

Market yield and credit spread information on loans or bonds of similar credit standing would also be of use.

Ratings

Recent ratings action reports by eligible ratings agencies (e.g. Moody’s, S&P, A.M. Best, NAIC) will inform of the current level of creditworthiness of the company as well as its debt. Also, obtain information on loss severities (LGDs) and/ or recovery rates, default rates, transitions and credit migrations.

Financial statements

Certain loan structures may link the applicable margin or fees to certain performance or leverage ratios of the company. Obtain financial statements available public or from the entity itself to calculate these ratios and assign the correct spread/ fee.

Drawn/ undrawn balances data

The borrower has the right to draw a credit line whenever needed during the life of the loan. The normal usage rate depends on what the company will use the facility for. Hence, the best source for information on the anticipated usage rate is the borrower.

The borrower may also provide information on draws from undrawn balances during periods of stress. Alternatively, impute the data from the difference in the contractual cost and market cost for obtaining additional credit. For this purpose use either the credit default swap spreads for the entity or yields on commercial paper issued by the entity.

2. Assumptions for the FAS 157 Fair Value model

Interest rate term structure

Obtain the risk free term structure to determine the discounted rates for the present valuing future cash flows. Bootstrap the par term structure to get the zero coupon and forward rates as of the valuation date. Use the zero coupon rate along with the credit spread mentioned below to discount future cash flows. Use the determined forward rates along with appropriate spreads and applicable margins to project future cash flows.

Credit Spreads

Market yield data for loans or bonds of similar credit rating will give an estimate of the credit spread on the valuation date. We may make an assumption that the spread remains constant over the life of the loan. Alternatively we may assume it may vary based on modelled credit migrations.

Default rates

Default rates may be assessed from data gathered on the most recent rating action as of the valuation date. It may be assumed as static over the life of the loan, or may be modelled.

Recovery rates

Data for recovery rates may be collected from market sources.

Normal usage rate for the revolving credit facility

The normal usage rate of the revolver may be provided by the client as they are in the best position to inform of the utilization. A static utilization rate may be based on the rate communicated by the client or the usage rate may be modelled based on the opportunity cost of credit available in the market.

Additional draws rate

Draws on revolvers tend to increase as the creditworthiness of the entity declines. We may assume a static assumption or model the usage rate based on the opportunity cost of credit available in the market.

Prepayment rates

We may ignore the prepayment rate assumption if we structure the cash flows of revolver repayments in such a manner to resemble a deterministic one period recurring loan in the valuation model. In particular, we may assume that the company prepays in full any withdrawals they make at the beginning of any interest period at the end of the interest payment period, and then redrawn again at the start of the next interest period.

3. Cash flows for the revolving credit facility

For the revolving credit facility cash flows include the revolver amounts drawn, the fees payable and the accrued interest on the outstanding revolver balance at the end of the interest payment period.

There is additional uncertainty as the option to draw lies with the borrower. Assumptions to the amount drawn and the timing of such a draw and repayment prior to the maturity, together with defaults will impact the contractual cash flows of the facility. For example, we may assume that at the beginning of each interest payment period, the entity draws an amount equal to the aggregate commitment times the normal usage rate. Accrued interest will apply to this amount and will be payable at the end of the period. Fees will apply to the drawn / undrawn balances and will be payable either at the beginning or end of the period. The company will repay the drawn balance in full at the end of the period. Repeat the process for each subsequent period.

We may assume defaults occur at the end of the period and comprise of a repayment of the full outstanding beginning of period balance together with accrued interest & fees payable for the period, adjusted for the proportion of this amount that will remain unrecovered because of the default event. Further, we may deduct additional draws due to anticipated default, adjusted for loss severity at the end of each period.

4. Valuation Model for calculating FAS 157 fair value for the revolving credit facility

The valuation model for the revolving credit facility projects the cash flows mentioned above for each future time step, including the valuation date and the maturity date of the loan. It then discounts these cash flows to derive a single value on the valuation date. The discount factor considers not only the time value of money, i.e. interest (zero coupon rate plus credit spread) but also the probability of default.

5. Results & Stress Testing

The results are fair values that we measure with significant unobservable Level 3 inputs as of the valuation date. Stress and sensitivity test them for the major assumptions that we use in the model. This includes the interest rate, credit spread, default rates, usage rates, transaction costs, etc.

References

- Building a credit risk valuation framework for loan instruments – Scott Aguais, Larry Forest and Dan Rosen – Algo Research Quarterly, Vol. 3, No. 3, December 2000, pp. 21–46.

- Statement of financial accounting standards No. 157 – Fair Value measurements – FASB – 2010

- Credit exposure and valuation of revolving credit lines – Robert A Jones & Yan Wendy Wu – 19 July 2009

- Questions you should be asking about Senior Secured Loans – Joe Lemanowicz – May 2011

- A one-parameter representation of credit risk and transition matrices – CreditMetrics Monitor Third Quarter 1998 (pp.46 -58)

- Ratings symbols and definitions – Moody’s Investor services – May 2016