Oil and Gold Models workshop – Bangkok, 14 November 2011

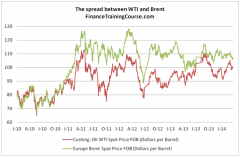

4 mins read The workshop focused on building models for oil and gold and also reviewed some of the associated risk limits with an emphasis on Pre-Settlement, Stop Loss, Transaction and Expectation driven limits. We reviewed price, volatility and relative value models and also took a look at fundamental drivers of pricing for Gold and Oil.