Financial Risk Management Course for MBA students

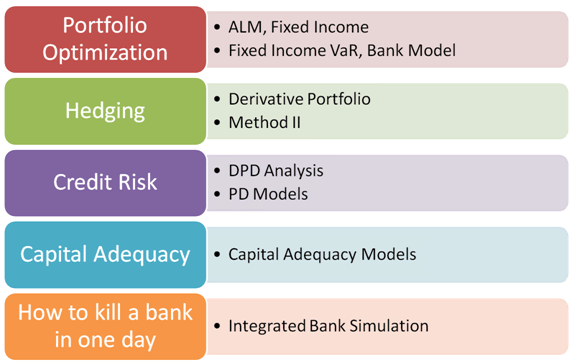

I am teaching a short week long course on Financial Risk Management at the SP Jain Campus in Dubai. For the next seven days I will work with 30 MBA students and complete a full review of:

a. Value at Risk

b. Measure translation and transaction exposures

c. Derivative Crash Course

d. Matching products and risk scenarios

e. Asset Liability Management

f. Risk Management practice

If you are interested in following the in class exercise, work with in class data and also take the assessment exams, go ahead and become a fan of the FinanceTrainingCourse.com site or its Facebook page. And then drop me a line or a message and I will add your name to the Risk Management Course mailing list.

The follow up course page (RM II) is now also up at Advance Risk Management Models Course

Updates:

After class every day I will post materials, comments, data and quizzes on the course page and the mailing list will receive those links. If you have questions, we will also pick the most interesting and relevant one and try and answer them on the course page over the duration of the next week.

The training course starts today.

Go ahead and give Risk Management a shot. See what the fuss is all about.

Here is the game plan for the next one week. The first two days are shared here. The full plan will be shared on the course page. Looking forward to seeing all of you in class.

Risk Case Analysis Approach Simplified – A few tips for analyzing cases used in this course

Your approach to handling a risk management case needs to:

- Agree on the method used to measure risk exposure

- Agree on the drivers of risk exposure and risk factor sensitivity (the relationship) between each driver and risk exposure value

- Agree on a selection of risk exposure drivers that will be modeled and hedged

- Design a risk hedge

- Evaluate the impact of the risk hedge by simulating or calculating worst case and extreme scenarios and the impact on the client under each such simulation.

- Calculate probability of shortfall if applicable and relevant.

- Present the results and your recommendations in the language of business to your board members.

- Share any reservations you may have about your model, your assumptions or your logic.

- Test your recommendations for practicality and implementation by running a small pilot hedging program and sharing the results

The Financial Risk Management Crash Course for MBA students

| Session | Topics | Recommended Reading |

| Financial Risk Workshop – Day One – Introduction | Risk, Volatility, Standard Deviation. What is Risk?A framework for risk management. Tools of the trade. Trailing VolatilityValue at Risk.Calculating Value at Risk. Introductory VaR Exercises with data set.Value at Risk Sheet. Value at Risk Methods | Case: Working with Gold and Oil PricesCase: Hedging Jet Fuel Exposure in the airline industry The Value at Risk Crash Course Counterparty Limits Movie clip – Margin Call – Boarding Meeting at 4 am. |

| Financial Risk Workshop – Day Two – Managing and Measuring Exposure | Working with hedging. Understanding and measuring exposure. Testing itApplying Value at RiskOil and Interest Rates- impact on car prices and air line business – Using Gold? | Case: Air CanadaCase: GM Translation and Transaction ExposuresReading material – Measuring Exposure for Petrochemical Companies |

| Financial Risk Workshop – Day Three – Basic Products and Applications | Derivative Language and terminology crash courseCommon products and applicationsForward, Puts, Calls. Common themes and relationships | Derivative Terminology Crash Course |

| Financial Risk Workshop – Day Four – Managing Exposure and Target Accounts- Asset Liability Management | Asset Liability Management, Report FormatsInterest Rate and Interest Rate Mismatch risk | Case: The BancOne ALM CaseAsset Liability Management Reference Guide |

| Financial Risk Workshop – Day Five – More Products & Applications | Advance products and solutions – Interest Rate Swaps, Caps, FloorsAdvance Derivatives Crash CourseExotic products | Derivative Terminology Crash Course |

| Financial Risk Workshop – Day Six – The LTCM Case Discussion | LTCM Case | |

| Financial Risk Workshop – Day Seven – Review, wrap up, closure | Risk practice in the real worldIssues and problems with Models.A career in risk managementLearning more about Risk and Risk practice | Internal Capital Adequacy Assessment Quant Crash Course |

Follow this page as we upload links to each day of classes and assignments below

Financial Risk Course Day One

Day One’s data sheet and homework. The sheet includes historical data series for Jet Fuel, WTI Crude Oil and Gold prices. It calculates historical volatility for Crude Oil as well as does a basic back test using a histogram. Also calculates Value at Risk for a WTI Crude Oil position using multiple confidence level.

Homework assignment. Repeat the calculations and the numbers for Jet Fuel and Gold. Calculate trailing correlation for Oil & Gold, Jet Fuel and Oil using the framework presented in the Tracking Trailing Correlations for Commodities post.

Financial Risk Workshop Day Two

- Introducing Value at Risk, Volatility and Trailing Correlations

- The Aviation Fuel Oil Hedging Case Study – Day Two update

- FinancialRiskTrainingOnline – Low Res Slide deck

- FinancialRiskTrainingCourse-HighRes – High Res Slide deck

Financial Risk Workshop – Day Three & Four

- Value at Risk Detailed Step by Step Case Study

- Asset Liability Management Detailed Step by Step Case Study

- Building Maturity Profile for ALM, Deposits and Advances Analysis

Financial Risk Management MBA Course – Session Transcripts and Podcasts

Day One Introduction – Session Transcripts

Day Two Aviation Fuel Hedging – Session Transcript

Day Three – Review – Session Transcript

Final Exam – Practice Test Question and Solved Solution

The Prime Brokerage – Margin Lending – Margin Risk Management Case Study

Also check the new Advance Risk Management Models Course, offered as a second course in the Risk Management series

Updates for both day one and day two have been posted can be seen at the links below.

- Update 28 June 2012 : Link to power point slide deck now available

- Update 28 July 2012: High res power point slide deck now available. Links to VaR and ALM Case Study now available.

- Update 28 September 2012: Final Exam and Solved Solution has been posted below and is now available

- Update 2nd August 2012: More transcripts from class sessions uploaded under the new transcript section on this page.

Hi Sir Jawwad Farid,

It’s a pleasure for me if you add me in your mailing list of Risk Management Course.

Regards

Taha Khalid Zaman

Dear Sir

I thank you for the wonderful opportunity you have given us for learning. please add me in your mailing list of Risk Management Course.

with regards

Iqbal Ahmed

Best of luck for your next schedule of 7 days. I hope this will be good time for you.

Thank you for this Golden opprtunity to learn.Kindly add my address to the mailing list for financial Risk management

Dear sir,

Is there any possiblility to get this material?

Thanks.

Dear Iris.

The study notes, session transcripts and the risk management training presentation (PDF) edition have been shared. You can also listen to the podcast for most of the lectures. Is there is anything specific that you need beyond the above?

Warm regards

Jawwad