Market Analysis

Crude Oil

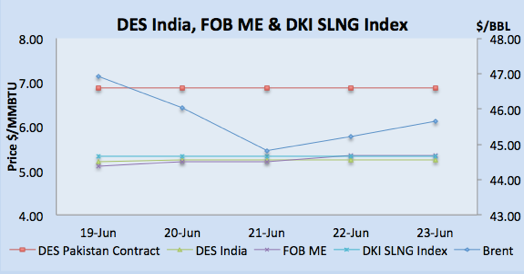

- Crude oil remained weak during the week with WTI closed at $43.10/BBL and Brent closed at $45.66/BBL on Friday, a decrease of 3.67% on Brent.

- The bearish tone is primarily due to the fact that OPEC cut is proving ineffective as 1.7 million b/d decrease from OPEC countries versus 1.5 million barrel production increase from US, Libya and Nigeria is resulting into very small production cut globally.

- Nigeria crude export will touch 2 million b/d mark in August, a 17 month high.

- EIA Weekly report recorded an inventory draw of 2.45 million barrels with stock at 509.1 million barrel on 16th June 2017 with market was expecting a draw of 2.0 million barrels.

- Gasoline inventories at 241.9 million barrel, recorded a draw of 0.6 million barrel, an unexpected draw, which will provide some support on refining utilization.

- As per Baker Hughes data, this week oil rigs increase by 11, reaching 758, with otal righ count including gas rigs increased by eight to 941, a consecutive 23rd weekly rise and a substantial rise of 11 oils rigs versus 6 oils rigs last week.

- My assessment, in order to stabilize oil prices, OPEC and non OPEC countries have to collaborate as OPEC production cuts are being proven ineffective so far.

Natural Gas

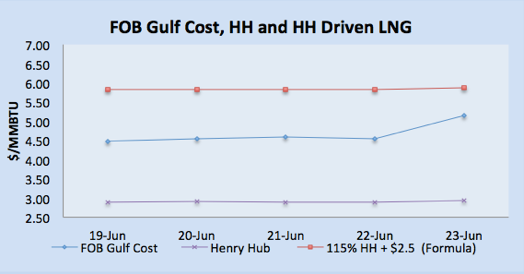

- Henry Hub prices closed on $2.93 /MMBTU on Friday.

- Henry Hub prices remained downward movement based upon weather forecast for next ten days predicting a colder forecast, which will hamper the demand for gas.

- US gas prices further slipped into bearish tone after EIA reports of Thursday suggesting higher inventory levels

- S. natural gas stocks increased by 61 BCF for the week ending June 16 versus market expectation of 58 BDF increase.

- The EIA reported that working gas in storage was 2,770 BCF as of Friday, June 16, stocks were 324 Bcf less than last year at this time and 207 Bcf above the five-year average of 2,563 Bcf. At 2,770 Bcf, total working gas is within the five-year historical range.

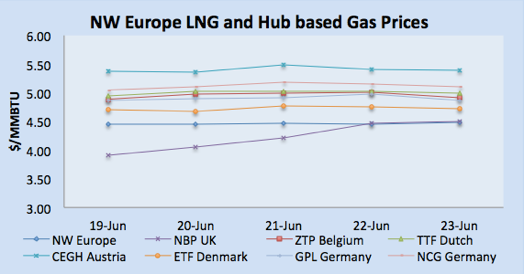

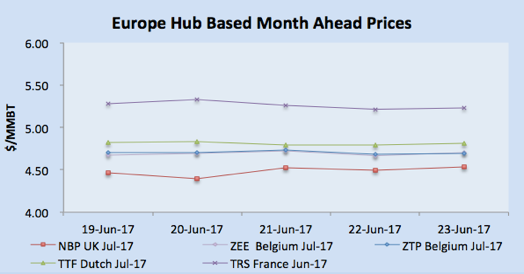

- NBP UK closed at 35.60 Pence/Therm (equivalent $4.50/MMBTU) as warmer weather pushing air-conditioning demand high plus some supply deficit in the pipelined gas.

- NBP future market remained weak for the month ahead market for July and August due to falling oil prices and closed at an equivalent of $4.53 and $4.65 per MMBTU basis.

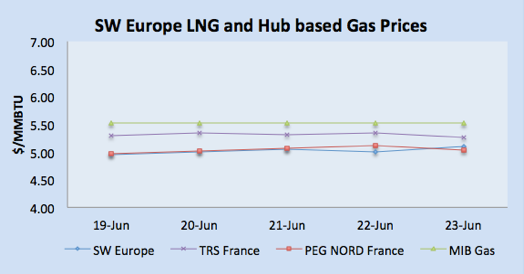

- Dutch and French gas prices remained weak despite a warmer weather due to the strength of Euro against GBP and USD, TTF and TRS France closed at an equivalent of $5.00 & $5.03/MMBTU on Friday.

- Future curve market at TTF and PEG NORD kept moving south due to weaker outlook on oil.

Currency

- The US dollar fell against all major currencies on anticipation of interest hike and slow down in inflation with US DXY down by 0.37% at 96.68.

- US Dollar bearish tone was also fueled by preliminary data on U.S. factory and services activities for June, which fell short of analyst forecasts, stoking doubts about U.S. economic growth for the rest of 2017.

- The euro was higher against the dollar, with EUR/USDrising 0.39% to 1.1194.

- GBP also gained ground against the greenback, with GBP/USD climbing 0.29% to 1.2718.

Weather

- European weather is getting pleasant in UK, Belgium, Netherland, German in the coming week, whereas Spain is in full summer season along with Portugal and France entering into the summer season.

- Temperature range for Argentina is 15-20oC and Brazil around 25oC for next week.

- Mexico will be around 23oC in the coming week.

- Middle East region summer season in full swing with Egypt touching 40oC, Kuwait is 45oC plus, and UAE temperature is going to be around low 40o

- Indian Subcontinent in hot summer season: with the temperature around 35oC in Pakistan and India for next week. India is relatively cooler due to Monsoon season.

- Summer season in North East Asia, with the temperature around 30oC plus in Taiwan, 28-30oC in Korea, China 30 -37oC, and Japan is around 26oC for next week.

- South East Asia already in hot weather with temperature in low 30o

- USA Weather: Overall weather is getting warmer but still lower than normal limits, along with Great plain and Mid Atlantic areas still cold weather.

LNG

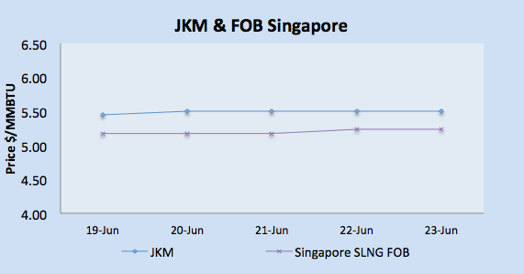

- Market remained stable due to increased interest from China along spot interest from India and Japan, prices in Asian market closed a bit high on Friday with JKM at $5.50/MMBTU, FOB Singapore $5.238/MMBTU and SLNG DKI Index at $5.325/MMBTU.

- DES India price inched by $0.05/MMBTU based upon GSPC tender otherwise demand in India is weak.

- European gas hub prices were stable to strong this week due to warm weather with TTF at $5.00/MMBTU, France at the equivalent of $5.03/MMBTU and Spanish market in high $5.50/MMBTU level.

- NBP prices will be more vulnerable from this winter as Britain’s biggest gas storage, Rough facility will be permanently closed, so more reliance on imported LNG.

- India has offered its terms to Qatar for inking long term supply deal if Qatar agrees to invest in power generation within India and for that purpose India has depicted interest to grant stakes in LNG terminal and local oil& gas companies.

- Iran claimed commencement of natural gas export to Baghdad via pipeline with an initial rate of 7 million cubic meters a day.

- Yamal LNG workers end five-day hunger strike, as Novatek pays wages.

- Freeport LNG to start commissioning train 1 in April 2018.

- Australian government to place regulation on curb of LNG export from eastern Australia at times of tight supply either by January 2018.

- Prompt demand from Korea and China along with higher temperature in Spain has pushed price slightly up. JKM traded $5.50/MMBTU on Tuesday.

- Indian Prices on Tuesday moved upward due to recent tender closing at $5.25-$5.30 price range, however, demand is still weak due to monsoon and high inventory at Dahej Terminal.

- KOGAS will be receiving its first cargo by early July 2017, the first cargo under 20 year, 2.8 MTPA deal with Cheniere as per market news.

- Mexico CFE tender for nine cargoes, with deliveries starting from end June till end August has been awarded at price around $5.30 level.

- British wholesale within day gas prices fell on Thursday morning following Brent crude oil losses and ahead of liquefied natural gas (LNG) arrivals, despite the undersupplied system and the lower Norway gas flows.

- India imported 3.11 million tons during April and May 2017, before the start of Monsoon season. India has 22 MTAP import capacity as of today.

- Italy’s Eni will start delivering LNG to Pakistan in December under a long-term contract of 15 years after revising its offer from an earlier bid of 12.29% of Brent. The supplies will be delivered to the second terminal, which is to be commissioned by 4Q 2017.

- ENI shipped first LNG cargo produced from Jangkrik field Indonesia to Indonesian domestic customer on Thursday.

- Ghana has entered into a Memorandum of Understanding with counterpart Oil producing country Equatorial Guinea for the supply of LNG, Quantum Power is developing FSRU based terminal located 12 kilometers off Tema’s shores.

- This week Sabine Pass export has declined due to tropical storm Cindy.

|

|

|

|

|

|

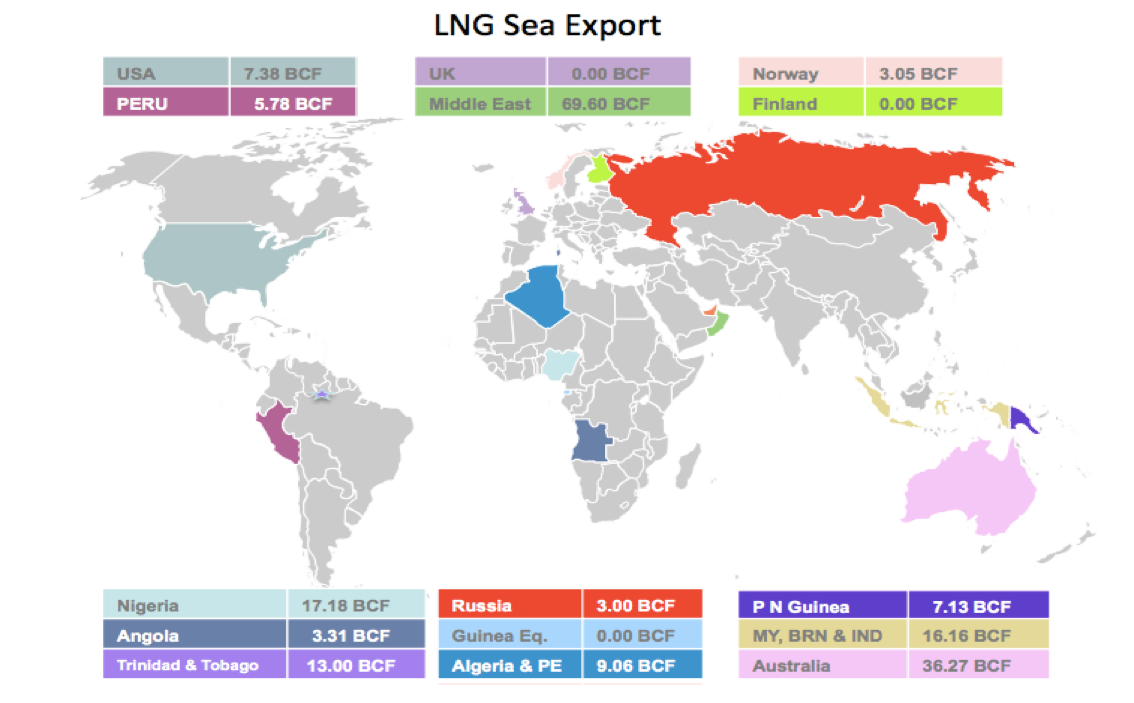

LNG Merchant Activity

- This week 60 vessels carrying 3.74 million tons (190.91 BCF) loaded from various supply centres, increased by 0.17 million tons from last week.

- 71 vessels carrying 4.93 million tons, approximately 40% of total June volumes have been dispatched from Ras Laffan, Qatar.

- 13 vessels dispatched for Indian ports account for 41.87 BCF.

- Five vessels carrying 17.18BCF departed from Nigerian port for European and Asian locations, one destined for India.

- Algeria loaded two vessels carrying 3.06 BCF for Spain.

- Norway loaded one cargo carrying 3.05BCF for Bilbao, Spain.

- Pont Fortin, Trinidad & Tobago loaded four vessels with 13.00BCF.

- Two vessels loaded this week from Sabine Pass, USA with 7.38 BCF destined for Mexico and European ports, decrease in loading is due to tropical storm Cindy.

- Two vessels loaded from Brunei with a load of 4.75 BCF.

- One vessel departed from Russia carrying 3.00 BCF for Japan.

- 11 vessels left from Australian export terminals of Dampier, Darwin and Gladstone ports for Japan, China, Korea, India and Singapore carrying 36.26 BCF.

- Middle Eastern terminals at Das Island (UAE) and Ras Laffan (Qatar) loaded 20 vessels carrying 69.60BCF for Asian destinations.

| Departure Date | Vessel Name | Capacity(CBM) | Loading Port | Discharge Port | LNG (BCF) |

| 19-Jun-17 | LA MANCHA KNUTSEN | 176,300 | Bonny, Nigeria | Dahej, India | 3.64 |

| 19-Jun-17 | LNG BAYELSA | 137,500 | Bonny, Nigeria | Europe | 2.84 |

| 20-Jun-17 | GASLOG GENEVA | 209,000 | Bonny, Nigeria | Atlantic Basin | 4.31 |

| 22-Jun-17 | YENISEI RIVER | 154,880 | Bonny, Nigeria | Not Confirmed | 3.20 |

| 21-Jun-17 | GASLOG SKAGEN | 154,948 | Bonny, Nigeria | Not Confirmed | 3.20 |

| 17-Jun-17 | GASLOG SANTIAGO | 154,948 | Punta Europa | South Atlantic | 3.20 |

| 20-Jun-17 | MADRID SPIRIT | 135,425 | Punta Europa | Not Confirmed | 2.79 |

| 19-Jun-17 | CHEIKH BOUAMAMA | 74,425 | Skikda, Algeria | Huelva, Spain | 1.54 |

| 22-Jun-17 | GLOBAL ENERGY | 74,130 | Skikda, Algeria | Barcelona, Spain | 1.53 |

| 21-Jun-17 | SONANGOL BENGUELA | 160,500 | Soyo, Angola | Not Confirmed | 3.31 |

| 20-Jun-17 | METHANE NILE EAGLE | 145,000 | Pampa Melchorita, Peru | Pacific Ocean | 2.99 |

| 22-Jun-17 | GALEA | 135,269 | Pampa Melchorita, Peru | Not Confirmed | 2.79 |

| 18-Jun-17 | SCF MITRE | 170,200 | Point Fortin, Trinidad | Not Confirmed | 3.51 |

| 22-Jun-17 | YARI LNG | 159,800 | Point Fortin, Trinidad | Atlantic Basin | 3.30 |

| 21-Jun-17 | BRITISH EMERALD | 154,983 | Point Fortin, Trinidad | Not Confirmed | 3.20 |

| 23-Jun-17 | GDF SUEZ CAPE ANN | 145,130 | Point Fortin, Trinidad | Not Confirmed | 2.99 |

| 17-Jun-17 | GOLAR CRYSTAL | 160,000 | Sabine Pass, USA | Not Confirmed | 3.30 |

| 19-Jun-17 | MARAN GAS HECTOR | 197,580 | Sabine Pass, USA | Altamira, Mexico | 4.08 |

| 20-Jun-17 | PUTERI NILAM SATU | 134,833 | Bintulu, Malaysia | Anegasaki, Japan | 2.78 |

| 22-Jun-17 | TRIPUTRA | 30,800 | Bontang, Indonesia | Benoa, Indonesia | 0.64 |

| 22-Jun-17 | LNG AQUARIUS | 126,750 | Bontang, Indonesia | Not Confirmed | 2.61 |

| 21-Jun-17 | GOLAR MAZO | 135,000 | Bontang, Indonesia | Not Confirmed | 2.79 |

| 18-Jun-17 | KUMUL | 172,000 | Lese, Papua New Guinea | Kawasaki, Japan | 3.55 |

| 23-Jun-17 | SPIRIT OF HELA | 173,800 | Lese, Papua New Guinea | Yung An, Taiwan | 3.59 |

| 20-Jun-17 | HYUNDAI UTOPIA | 125,182 | MIGAS LNG BATU, Indonesia | Pyeongtaek, Korea | 2.58 |

| 21-Jun-17 | CYGNUS PASSAGE | 145,400 | Prigorodnoye, Russia | Kisarazu, Japan | 3.00 |

| 19-Jun-17 | AMADI | 155,000 | Sieria Oil Terminal, Brunei | Not Confirmed | 3.20 |

| 21-Jun-17 | BEBATIK | 75,056 | Sieria Oil Terminal, Brunei | Not Confirmed | 1.55 |

| 18-Jun-17 | DAPENG MOON | 147,200 | Dampier, Australia | Shenzen, China | 3.04 |

| 19-Jun-17 | METHANE PATRICIA CAMILA | 167,416 | Dampier, Australia | Not Confirmed | 3.45 |

| 22-Jun-17 | DWIPUTRA | 127,386 | Dampier, Australia | Not Confirmed | 2.63 |

| 23-Jun-17 | ENERGY HORIZON | 177,441 | Dampier, Australia | Anegasaki, Japan | 3.66 |

| 23-Jun-17 | DAPENG SUN | 147,200 | Dampier, Australia | Dafeng, China | 3.04 |

| 19-Jun-17 | ENERGY PROGRESS | 144,596 | Darwin, Australia | Chiba, Japan | 2.98 |

| 19-Jun-17 | K.MUGUNGWHA | 148,776 | Gladstone, Australia | Korea | 3.07 |

| 18-Jun-17 | CESI QINGDAO | 205,000 | Gladstone, Australia | Qindago, China | 4.23 |

| 20-Jun-17 | PALU LNG | 159,800 | Gladstone, Australia | Pacific Basin | 3.30 |

| 22-Jun-17 | MARAN GAS TROY | 159,800 | Gladstone, Australia | Pacific Region | 3.30 |

| 23-Jun-17 | STENA CLEAR SKY | 173,593 | Gladstone, Australia | Dahej, India | 3.58 |

| 23-Jun-17 | ARCTIC PRINCESS | 147,835 | Melokya, Norway | Bilbao, Spain | 3.05 |

| 19-Jun-17 | SHAHAMAH | 137,756 | Das, UAE | Kisarazu, Japan | 2.84 |

| 23-Jun-17 | AL KHAZNAH | 137,450 | Das, UAE | Kawasaki, Japan | 2.84 |

| 18-Jun-17 | AAMIRA | 260,912 | Ras Laffan, Qatar | Suez Canal, Egypt | 5.38 |

| 19-Jun-17 | ASEEM | 154,948 | Ras Laffan, Qatar | Dahej, India | 3.20 |

| 18-Jun-17 | ONAIZA | 205,963 | Ras Laffan, Qatar | Far East | 4.25 |

| 18-Jun-17 | AL DAAYEN | 148,853 | Ras Laffan, Qatar | Suez Canal | 3.07 |

| 18-Jun-17 | GASELYS | 151,383 | Ras Laffan, Qatar | Hazira, India | 3.12 |

| 17-Jun-17 | TAITAR NO.1 | 154,948 | Ras Laffan, Qatar | Taichung, Taiwan | 3.20 |

| 20-Jun-17 | TAITAR NO.2 | 144,627 | Ras Laffan, Qatar | Taichung, Taiwan | 2.98 |

| 20-Jun-17 | GOLAR SNOW | 160,000 | Ras Laffan, Qatar | Pacific Basin | 3.30 |

| 19-Jun-17 | LIJMILIYA | 258,019 | Ras Laffan, Qatar | Middle East | 5.32 |

| 19-Jun-17 | ASEEM | 154,948 | Ras Laffan, Qatar | Dahej, India | 3.20 |

| 19-Jun-17 | SIMAISMA | 142,971 | Ras Laffan, Qatar | Not Confirmed | 2.95 |

| 22-Jun-17 | RAAHI | 138,077 | Ras Laffan, Qatar | Dahej, India | 2.85 |

| 22-Jun-17 | UMM BAB | 143,708 | Ras Laffan, Qatar | Port Qasim, Pakistan | 2.96 |

| 22-Jun-17 | FUWAIRIT | 138,262 | Ras Laffan, Qatar | Taichung, Taiwan | 2.85 |

| 21-Jun-17 | DISHA | 136,026 | Ras Laffan, Qatar | Not Confirmed | 2.81 |

| 21-Jun-17 | DUKHAN | 137,622 | Ras Laffan, Qatar | Suez Canal | 2.84 |

| 23-Jun-17 | AL BAHIYA | 205,981 | Ras Laffan, Qatar | Singapore | 4.25 |

| 23-Jun-17 | AL MAYEDA | 261,157 | Ras Laffan, Qatar | Far East | 5.39 |