Market Analysis

Crude Oil

- Crude oil prices remained bearish throughout the week primarily based upon news on IEA report on enhanced demand for 2H 2017, import growth in China, weaker USD, EIA inventory data plus force majeure declaration from Nigeria and trading covering their short position.

- As per Chinese custom data, crude oil imports over the first six months of 2017 were 13.8% higher than last year.

- Brent price increased by 4.71%, while WTI rose by 5.20% from last Friday. Brent closed at $48.91/BBL whereas WTI at $46.54/BBL on Friday.

- EIA Weekly report reported a draw of 7.6 million barrels with stock at 495.4 million barrels on 7th July 2017 from 502.9 million barrel on 30th June 2017.

- Gasoline inventories at 235.7 million barrel reported on 7th July 2017, recorded a draw of 1.6 million barrel against market expectation of inventory build up of 1.1 million barrels.

- Baker Hughes rig count reported an increase of 2 oils rigs, raising it to 765, whereas gas rig decreased by two to 187, with total number of rigs at 952.

- Long term price outlook still weak due to surplus quantities attributed to ineffectiveness of OPEC production cut and rising US shale production.

- Libya and Nigeria have contributed 393,000 BPD increase in June from May, and last two months increase is 440,000 BPD, almost the same volume Saudi Arab is reducing on monthly basis.

- My assessment is crude oil price will remain under pressure on long-term basis, and OPEC has to consider more production cuts along with capping both Nigeria and Libya.

Natural Gas

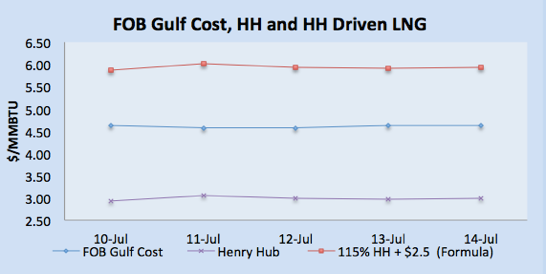

- Henry Hub prices increased by 4.05% to $2.98/MMBTU on Friday from last Friday’s price of $2.93/MMBTU.

- Bullish trend is primarily due to warmer than normal weather expectation along with decreased number of gas rigs reported this week.

- S. natural gas stocks increased by 57 BCF for the week ending July 7th versus market expectation of 59 BCF increase.

- Working gas in storage was 2,945 BCF as of Friday, July 7th. Stocks were 289 BCF less than last year at this time and 172 BCF above the five-year average. At 2,945 BCF, total working gas is within the five-year historical range.

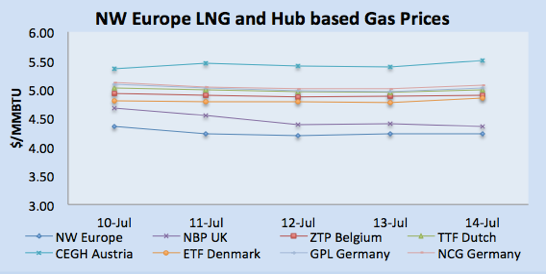

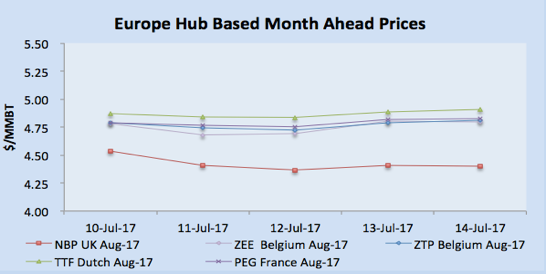

- NBP UK kept on moving south and closed at 33.30 Pence/Therm (equivalent $4.35/MMBTU).

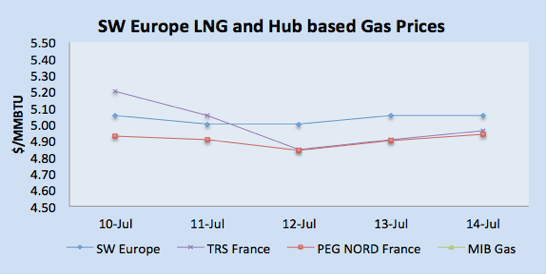

- Spanish gas prices closed at €16.90/MWH (equivalent of $5.673/MMBTU) on Friday.

- TTF closed at €14.89/MWH (equivalent of $5.00/MMBTU) and PEG Nord France closed at €14.71/MWH ($4.94/MMBTU) on Friday.

- European Hub future price (Equivalent $/MMBTU basis) for September on Friday were: NBP $4.73/MMBTU, TTF $4.96/MMBTU & PEG Nord $4.93/MMBTU.

Currency

- Throughout the week USD remained volatile with DXY closed on Friday at 94.90 versus last week Friday closing at 95.80.

- This is USD worst performance in last ten months against a basket of global currencies due to weakness in US economy depicted via in inflation rate of 1.6% in June from 1.9% in May and weak retail sales data with 0.2% dip.

- Both GBP and Euro were the beneficiaries of weak greenback and remained strong through out the week.

- The euro gained ground, with EUR/USDadvancing 0.62% to 1.1469.

- GBP/USD closed $1.3076 on Friday.

Weather

- Summer in Europe with UK and Belgium remained warm, and expected to remain warm in the coming week. Netherland and France was around 20 oC and expected to be warm next week. Spain remained hot and expected to remain hot next week and Portugal will be around 25oC next week.

- Temperature in Argentina remained around 13-18oC and expected to remain same in the coming week. Brazil remained around 20-25oC and expected to be around 30oC next week.

- Mexico will be around 23oC in the coming week same as this week

- Middle East region summer season in full swing with Egypt around 40oC, Kuwait touched 50oC, and UAE temperature reached 45oC and will remain the same next week.

- Indian Subcontinent in hot summer season: with temperature around 35-40oC in Pakistan and India around 35o Same weather profile for the next week.

- Summer season in North East Asia, with temperature around 33-35oC in Taiwan, 30-33oC in Korea, China 32oC, and Japan is around 30oC for next week.

- South East Asia already in hot weather, Thailand around 30oC, Indonesia and Malaysia ranging between 32-35oC, and will remain same next week.

- USA Weather: Overall weather is warmer than normal with outlook of 30oC for next two weeks.

- Indian Subcontinent in hot summer season: with temperature around 35-40oC in Pakistan and India around 35o Same weather profile for the next week.

- Summer season in North East Asia, with temperature around 33-35oC in Taiwan, 30-33oC in Korea, China 35oC, and Japan is around 30oC for next week.

- South East Asia already in hot weather, Thailand around 35oC, Indonesia and Malaysia ranging between 32-35oC, and will remain same next week.

- USA Weather: Overall weather is hot with 30oC and weather forecast remain same for next week.

LNG

- Overall market sentiments are bearish with August there is not much interest reported for Pacific basin, whereas Atlantic market activities were limited to Mexico and some interest observed in Middle Eastern and Chinese markets.

- Jordon’s NEPCO has issue a tender for 32 cargoes throughout 2018 in four different delivery options of 16, 6, 4 and 6 cargoes to be delivered at Al-Sheikh Sabah LNG Terminal at Aqaba.

- Market participants are on the side lines focusing more on September cargoes though its still a buyer’s market due to over supply situation from Australia and Indonesia along with regular cargoes from other regional players like Qatar and US.

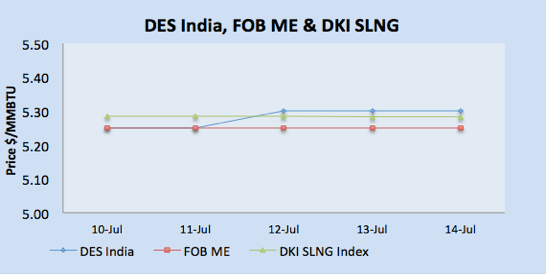

- Asian market closed on Friday with JKM at $5.40/MMBTU, FOB Singapore $5.176/MMBTU, SLNG DKI at $5.283/MMBTU.

- Indian buyers still waiting as inventories still are high at storage and good monsoon‘s rains has resulted in lower electricity demand.

- Indian prices closed on Friday within a ranges of $5.28-$5.30/MMBTU level.

- Overall demand witnessed in Europe for Spanish market. Where hot weather has resulted in increase air-conditioning demand.

- CFE’s three cargoes for September delivery is heard to be finalized at $4.95 level, which is basically based upon netback comparison between Spanish and Mexican market for US producers.

- Assuming TTF price September price plus 20 cents premium and freight cost 20 cents per MMBTU, translate into $4.95 level, whereas Spanish spot gas price of $5.65/MMBTU equivalent with 45 cents freight cost and 25 cents re-gas charges also translate into same netback for US producers.

- JKM future for August is trading at $5.525/MMBTU whereas September delivery is traded $5.700/MMBTU, with spot price at $5.400 MMBTU level.

- LNG market deregulations, Japan and EU signed an MoU for cooperation to remove the terms pertaining to re-selling on LNG cargoes. This step will certainly help in transforming LNG market more liquid and practical.

- Bangladesh first ever FSRU based LNG project is progressing with debt financing been arranged with IFC being the lead arranger along with CDC Group, DEG, FMO and JICA. The project is co-developed by IFC and Excelerate Energy Bangladesh.

- Indonesia domestic production increase has resulted in no demand for imported LNG. The Jangkrik gas field is producing higher than expected, with deign capacity of 450 MMSCFD, whereas production can go up-to 600 MMSCFD. Point to be noted that Indonesia still is LNG exporter however lost export market due to expected rise in domestic need which didn’t not developed.

- Pakistan’s Petroleum Minister announced that Pakistan could become one of the world’s top five LNG importer by 2022 with 30 MTPA. This is possible, however Pakistan needs to put up 5 more regas terminal of 600 MMSCFD, along with additional downstream capacity of 2.8 BCF.

- South Korea’s shift from coal and nuclear towards renewables and liquefied natural gas for power generation could help soak up growing supplies of the super-cooled fuel in the coming years.

- CFE second auction of gas transportation capacity has been closed without any award due to lack of interest from byers as no one has submitted a bid.

- Bangladesh signed its first ever LNG import deal with Qatar’s RasGas priced on Brent basis. The deal is for 2.5 MTPA for 15 years, the deal seems like at par with what is prevailing in the region like Pakistan, India and Egypt.

- Japanese buyers has initiated talk after FTC’s verdict on destination clause, for the renewal of LNG supply contract on revised terms focusing more on flexibility like destination and resale along with downward revision on prices

- USA is on track to become the world’s second largest exporter of LNG by the end of 2022, just behind Australia and ahead of Qatar, reported by IEA. BY 2020, Australia would have capacity to export 117.8 BCM a year of LNG, followed by the USA with 106.7 BCM a year and Qatar with 104.9 BCM a year.

- Bahrain is holding talks with Gazprom about imports of 3-6 MTPA for its new terminal.

- India breaks ground for Dhamra LNG terminal in eastern India with 5 MTPA capacity.

- The Australian government lowered its forecast for the country’s fiscal 2017-18 (July-June) LNG exports by 3.8 million mt, due mainly to the later-than-expected start-up of Inpex’s Ichthys LNG project.

- My assessment on LNG market is, that price will remain weak due to over supply situation and low crude prices.

|

|

|

|

|

|

LNG Merchant Activity

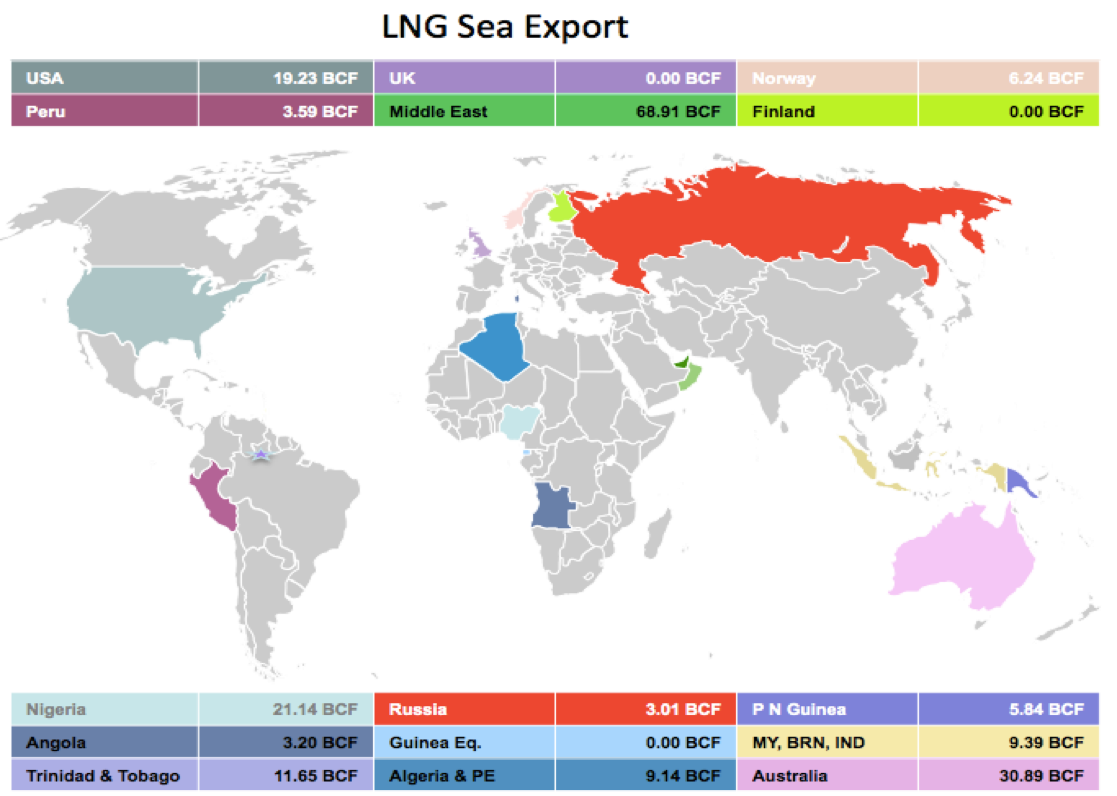

- This week 59 vessels carrying 3.83 million tons (192.24 BCF) loaded from various supply centres, a decrease of 0.222 million tons from last week.

- 36 vessels carrying 2.47 millions tons, approximately 32% of MTD volume have been dispatched from Ras Laffan, Qatar.

- 3 vessels left for Indian ports while one left for Port Qasim Port, Pakistan, total volume dispatched 12.30 BCF this week.

- Six vessels carrying 21.14 BCF departed from Nigerian port for European, South American and Asian locations

- Algeria loaded two cargoes carrying 3.06 BCF for France and Spain.

- Pont Fortin, Trinidad & Tobago loaded four vessels with 11.65 BCF.

- Five vessels loaded this week from Sabine Pass, USA with 19.23 BCF, with one destined for Korea.

- One vessel loaded from Brunei with load of 2.79 BCF.

- 10 vessels left from Australian export terminals of Dampier, Darwin and Gladstone ports for Japan, China, Korea and Singapore carrying 30.89

- Middle Eastern terminals at Das Island (UAE), Qalhat (Oman) and Ras Laffan (Qatar) loaded 20 vessels carrying 68.91 BCF for Asian and European destinations.

| Departure Date | Vessel Name | Capacity(CBM) | Loading Port | Discharge Country | ETA Discharge Port | LNG (BCF) |

| 13-Jul-17 | GASLOG GLASGOW | 232,000 | Bonny, Nigeria | Atlantic Basin | 26-Jul-17 | 4.79 |

| 8-Jul-17 | LNG LAGOS II | 177,000 | Bonny, Nigeria | Europe | 18-Jul-17 | 3.65 |

| 9-Jul-17 | LNG OGUN | 149,600 | Bonny, Nigeria | France | 21-Jul-17 | 3.09 |

| 13-Jul-17 | TRINITY ARROW | 152,655 | Bonny, Nigeria | North Atlantic | 03-Aug-17 | 3.15 |

| 13-Jul-17 | LNG BORNO | 149,600 | Bonny, Nigeria | Spain | 24-Jul-17 | 3.09 |

| 11-Jul-17 | MARAN GAS APOLLONIA | 164,000 | Bonny, Nigeria | 04-Aug-17 | 3.38 | |

| 9-Jul-17 | MARAN GAS LINDOS | 159,800 | Punta Europa | Not Known | 3.30 | |

| 14-Jul-17 | BILBAO KNUTSEN | 135,049 | Punta Europa | 29-Jul-17 | 2.79 | |

| 14-Jul-17 | GLOBAL ENERGY | 74,130 | Skikda, Algeria | France | 15-Jul-17 | 1.53 |

| 9-Jul-17 | GLOBAL ENERGY | 74,130 | Skikda, Algeria | Spain | 12-Jul-17 | 1.53 |

| 11-Jul-17 | CUBAL | 154,948 | Soyo, Angola | India | 03-Aug-17 | 3.20 |

| 9-Jul-17 | GIGIRA LAITEBO | 173,870 | Pampa Melchorita, Peru | Japan | 25-Jul-17 | 3.59 |

| 9-Jul-17 | IBERICA KNUTSEN | 135,230 | Point Fortin, Trinidad | Argentina | 21-Jul-17 | 2.79 |

| 14-Jul-17 | METHANE PRINCESS | 136,086 | Point Fortin, Trinidad | Far East | 05-Aug-17 | 2.81 |

| 12-Jul-17 | BRITISH MERCHANT | 138,517 | Point Fortin, Trinidad | Israel | 26-Jul-17 | 2.86 |

| 11-Jul-17 | GASLOG SHANGHAI | 154,948 | Point Fortin, Trinidad | Pacific Basin | 30-Jul-17 | 3.20 |

| 9-Jul-17 | RIBERA DEL DUERO KNUTSEN | 173,400 | Sabine Pass, USA | Colombia | 20-Jul-17 | 3.58 |

| 13-Jul-17 | K.JASMINE | 142,961 | Sabine Pass, USA | Korea | 21-Aug-17 | 2.95 |

| 10-Jul-17 | MARAN GAS OLYMPIAS | 235,400 | Sabine Pass, USA | Pacific Basin | 15-Jul-17 | 4.86 |

| 8-Jul-17 | HYUNDAI PEACEPIA | 207,000 | Sabine Pass, USA | 08-Aug-17 | 4.27 | |

| 11-Jul-17 | CREOLE SPIRIT | 173,400 | Sabine Pass, USA | 3.58 | ||

| 10-Jul-17 | CORCOVADO LNG | 159,800 | Bintulu, Malaysia | Not Known | 15-Jul-17 | 3.30 |

| 8-Jul-17 | COOL EXPLORER | 160,000 | Bintulu, Malaysia | Singapore | 10-Jul-17 | 3.30 |

| 8-Jul-17 | GALICIA SPIRIT | 137,814 | Lese, Papua New Guinea | Japan | 10-Jul-17 | 2.84 |

| 10-Jul-17 | PACIFIC ARCADIA | 145,400 | Lese, Papua New Guinea | Japan | 21-Jul-17 | 3.00 |

| 12-Jul-17 | GRAND MEREYA | 145,964 | Prigorodnoye, Russia | Taiwan | 18-Jul-17 | 3.01 |

| 12-Jul-17 | ABADI | 135,269 | Sieria Oil Terminal, Brunei | Not Known | 2.79 | |

| 12-Jul-17 | DAPENG SUN | 147,200 | Dampier, Australia | China | 19-Jul-17 | 3.04 |

| 8-Jul-17 | NORTHWEST SHEARWATER | 125,660 | Dampier, Australia | Japan | 18-Jul-17 | 2.59 |

| 10-Jul-17 | NORTHWEST SNIPE | 127,747 | Dampier, Australia | Japan | 21-Jul-17 | 2.64 |

| 9-Jul-17 | ENERGY NAVIGATOR | 147,558 | Dampier, Australia | Japan | 18-Jul-17 | 3.04 |

| 12-Jul-17 | WOODSIDE ROGERS | 159,800 | Dampier, Australia | Pacific Basin | 27-Jul-17 | 3.30 |

| 14-Jul-17 | NORTHWEST STORMPETREL | 125,525 | Dampier, Australia | 2.59 | ||

| 10-Jul-17 | CESI GLADSTONE | 174,000 | Gladstone, Australia | China | 20-Jul-17 | 3.59 |

| 12-Jul-17 | GASLOG SYDNEY | 154,948 | Gladstone, Australia | China | 23-Jul-17 | 3.20 |

| 14-Jul-17 | METHANE JULIA LOUISE | 167,416 | Gladstone, Australia | Far East | 24-Jul-17 | 3.45 |

| 10-Jul-17 | METHANE PATRICIA CAMILA | 167,416 | Gladstone, Australia | Not Known | 3.45 | |

| 12-Jul-17 | ARCTIC PRINCESS | 147,835 | Melokya, Norway | Denmark | 17-Jul-17 | 3.05 |

| 9-Jul-17 | ARCTIC AURORA | 154,800 | Melokya, Norway | Turkey | 20-Jul-17 | 3.19 |

| 13-Jul-17 | GOLAR MARIA | 145,700 | Das, UAE | Europe | 23-Jul-17 | 3.01 |

| 8-Jul-17 | MRAWEH | 135,000 | Das, UAE | Japan | 24-Jul-17 | 2.79 |

| 11-Jul-17 | HYUNDAI OCEANPIA | 134,300 | Qalhat, Oman | Korea | 25-Jul-17 | 2.77 |

| 12-Jul-17 | AL RUWAIS | 205,994 | Ras Laffan, Qatar | China | 02-Aug-17 | 4.25 |

| 12-Jul-17 | AL DAFNA | 261,988 | Ras Laffan, Qatar | Far East | 5.41 | |

| 12-Jul-17 | RAAHI | 138,077 | Ras Laffan, Qatar | India | 15-Jul-17 | 2.85 |

| 12-Jul-17 | KITA LNG | 159,800 | Ras Laffan, Qatar | Indian Ocean | 06-Aug-17 | 3.30 |

| 9-Jul-17 | AL SADD | 205,963 | Ras Laffan, Qatar | Japan | 25-Jul-17 | 4.25 |

| 12-Jul-17 | AL WAKRAH | 134,624 | Ras Laffan, Qatar | Japan | 01-Aug-17 | 2.78 |

| 10-Jul-17 | SK STELLAR | 135,540 | Ras Laffan, Qatar | Korea | 26-Jul-17 | 2.80 |

| 13-Jul-17 | AL REKAYYAT | 145,000 | Ras Laffan, Qatar | Kuwait | 15-Jul-17 | 2.99 |

| 14-Jul-17 | ENERGY ATLANTIC | 132,588 | Ras Laffan, Qatar | Mediterian | 22-Jul-17 | 2.74 |

| 14-Jul-17 | AL KHUWAIR | 211,885 | Ras Laffan, Qatar | Mediterian | 21-Jul-17 | 4.37 |

| 10-Jul-17 | SIMAISMA | 142,971 | Ras Laffan, Qatar | Not Known | 2.95 | |

| 12-Jul-17 | MARAN GAS ASCLEPIUS | 142,906 | Ras Laffan, Qatar | Pakistan | 15-Jul-17 | 2.95 |

| 9-Jul-17 | MOZAH | 261,988 | Ras Laffan, Qatar | Singapore | 20-Jul-17 | 5.41 |

| 11-Jul-17 | AL HAMLA | 211,862 | Ras Laffan, Qatar | Suez Canal | 19-Jul-17 | 4.37 |

| 8-Jul-17 | TAITAR No. 4 | 144,596 | Ras Laffan, Qatar | Taiwan | 21-Jul-17 | 2.98 |

| 14-Jul-17 | TAITAR NO.1 | 154,948 | Ras Laffan, Qatar | Taiwan | 28-Jul-17 | 3.20 |

| 14-Jul-17 | HYUNDAI TECHNOPIA | 134,524 | Ras Laffan, Qatar | 30-Jul-17 | 2.78 |