Market Analysis

Crude Oil

- Crude oil resumed the bullish tone on Monday and remained bullish through out the week. However market participants still concerned about the fragility of the upward price movement.

- This week bullish trend is attributed to US inventory number, weaker USD, global geopolitical tension and prospect of sanction and oil majors trying to cap the export.

- Brent price closed at $52.52/BBL an increase by 9.28% from last Friday, whereas WTI closed at $49.71/BBL on Friday increased by 8.61% from last Friday..

- EIA Weekly report reported a draw of 7.21 million barrels with stock at 483.4 million barrel on 21st July 2017, with market expectations were of 2.7 million barrels draw.

- Gasoline inventories at 230.2 million barrel reported on 21st July 2017, recorded a draw of 1.0 million barrel.

- Escalation of geopolitical tension as US is threatening Iran, Russia and Venezuela for tighter sanctions.

- OPEC and Non OPEC joint ministerial monitoring meeting on Monday hasn’t been able to put forward any sentiments, however Saudi Arabia has pledged to cut it exports in August to 6.6 million B/D, reduction by 300,000 B/D.

- However OPEC is considering to cap Nigeria and Libyan production at a joint production of 2.8 million B/D, will put more pressure on oil prices.

- Baker Hughes rig count reported an increase of 2 oil rigs, with total standing at 766, whereas gas rig increase by 6 and now at 192, with total number of rigs at 958.

- Overall crude oil price bullish trend horizon is not clear, as fundamentals still remain unchanged with over supply situation still prevailing. OPEC and US has to work together to cut down the production.

Natural Gas

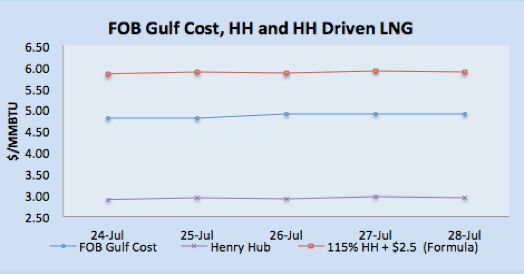

- Henry Hub prices closed at $2.94/MMBTU, down by 0.98% from last week, however remained within 2.95 range throughout the week.

- Weather forecast is almost same as last week, so weather based price adjustment already incorporated, however hot condition persisting in West and Central areas.

- S. natural gas stocks increased by 17 BCF for the week ending July 21st versus market expectation of 24 BCF increase.

- Working gas in storage was 2,990 BCF as of Friday, July 21st. Stocks were 302 BCF less than last year at this time and 111 BCF above the five-year average. At 2,990 BCF, total working gas is within the five-year historical range.

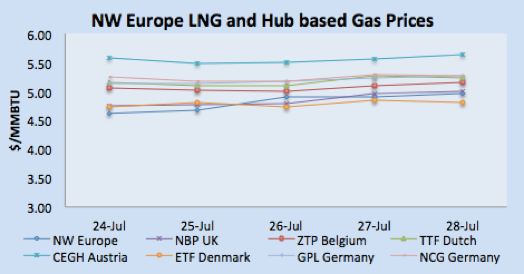

- NBP UK remained bullish from the start of week, primarily on technical problems at the Kollsnes gas plant in Norway, as of 28th July Norwegian are down putting pressure on prices. NBP UK prices also took support from strong crude oil prices.

- Supply is expected to more than adequate in coming future as beside pipelined supplies, 4 LNG cargoes are confirmed for France in the coming week.

- NBP UK day ahead prices closed 38.1120 Pence/Therm (equivalent $$5.00/MMBTU).

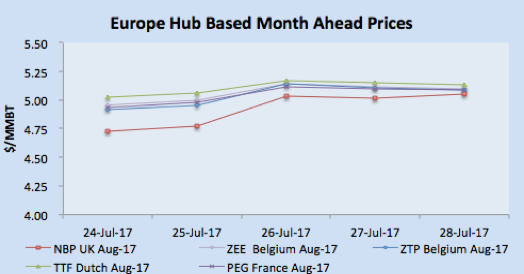

- Dutch and French gas prices remained stable due to warm weather during the week, however closed low on Friday due to greater flows of Russian gas into Europe.

- TTF closed at €15.17/MWH (equivalent of $5.22/MMBTU) and PEG Nord France closed at €14.99/MWH ($5.16/MMBTU) on Friday.

Currency

- Despite positive news from US Bureau of Economic Analysis, the USD remained bearish due to Federal Reserve’s comment and latest political concerns.

- Federal Reserve’s commented about inflation remains below than its target of 2%, which has casted doubts about third rate hike this year.

- On the political front, USD is weak, as Senate has failed to pass Obamacare repeal bill on 49-51 votes, which highlighted rejection within republicans plus senate strict instance on Russian sanction.

- The S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, fell to 93.34 on Friday against 93.39 of last Friday.

- Euro has been strong as optimism continued on growing Eurozone economy and possible winding down of monetary stimulus by ECB.

- EURO/USD closed at 1.1750 on Friday at a level last seen in January 2015, beside Euro Zone strong economic factor, US dollar weak performance is also contributing as Fed is maintaining the status quo by keeping the rates on hold.

- GBP gained momentum against and closed at 1.3133 on Friday at the end of American session. The USD lost strength after the US GDP report and news on Fed keeping the rates unchanged.

Weather

- UK, Netherland and Belgium weather still remained pleasant this week between 19-24oC and UK & Netherland will remain same while Belgium will a bit more warm around 26o

- France remained pleasant that the forecast with temperature around 22oC however expected to be warm next week with 25-29oC range.

- Spain & Portugal in peak summer season, and expected to be warm next week with Spain around 35oC and Portugal around 26o

- Temperature in Argentina remained around 15-20oC, and expected to be cold around 15oC in the coming week.

- Mexico remained around 24oC this week and forecasted to remain the same in the next week.

- Middle East region summer season in full swing with Egypt around 38oC, Kuwait touched 50oC, and UAE temperature reached 45oC and will remain the same next week.

- Indian Subcontinent in hot summer season: with temperature around 35-40oC in Pakistan and India around 35o Same weather profile for the next week.

- Temperature remained hot in North East Asia, with temperature around 36-38oC in Taiwan, 30-35oC in Korea, China 28-40oC, and Japan is around 30oC, expected to remain same for the next week.

- South East Asia already in hot weather, Thailand around 30oC, Indonesia and Malaysia ranging between 32-35oC, and will remain same next week.

- USA Weather: Overall weather is remained warm, however North East and Pacific region getting warmer.

LNG

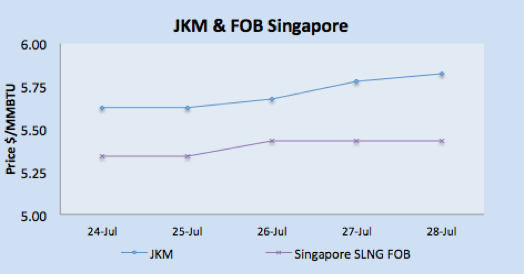

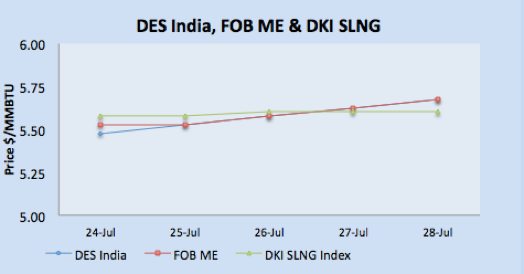

- Asian market closed on Friday with JKM at $5.8250/MMBTU, FOB Singapore $5.4330/MMBTU, SLNG DKI at $5.6010/MMBTU for September delivery.

- JKM future for September is trading at $5.710/MMBTU whereas October delivery is traded $6.025/MMBTU.

- This week upward movement is attributed to demand coming from India and Japan along with supply disruption from Peru resulted in activities for replacement cargoes.

- Hot weather in North East Asia has resulted in higher consumption of gas, and Japanese utilities are in the market for Spot September delivery cargoes.

- GSPC and Indian Oil both in the market, where GSPC finalized the August delivery cargo, whereas IOC still looking for the cargo.

- LNG deals in India were heard done between $5.60-$5.75/MMBTU.

- Beside the issue at Peru, where export was halted due to bad weather, overall supply situation is still long.

- There are cargoes available from existing supplier in Qatar, Nigeria, Angola, Abu Dhabi along with Egypt’s Idku and Australia Wheatstone project.

- There is news of first two commissioning cargoes from Chevron’s Wheatstone project for mid September loading, whereas Chevron’s Gorgon is due for maintenance in September and Curtis LNG project is expected to undergo a maintenance turnaround in October.

- There is upcoming loading from Egypt’s Idku liquefaction plant.

- Ramp up in feed gas flow at Cheniere Energy liquefaction facility indicates that fourth line has entered into service.

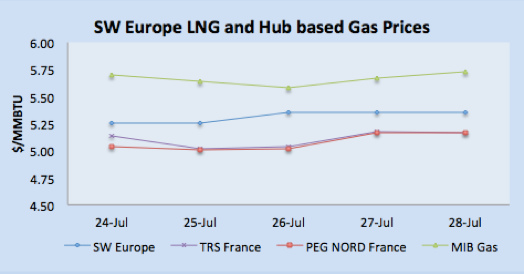

- Demand for imported LNG in European markets is low, as there are ample supply from Algeria, Nigeria and US along resumption of pipeline supply from Russian and Norway.

- Hot weather in Spain and Portugal has increased the demand for electricity however demand for LNG is not picking up as renewable generation levels are stable.

- European gas hub prices remained stable with NBP UK prices spiked further in the later half of the week due to, NW Europe price heard at minor discount with NBP UK and around $0.20/MMBTU with TTF.

- Gas prices in the Iberian Peninsula for Spain and Portugal remained stable. Prices in France followed the same trend as UK due to outages issues in Norway. France is expecting four cargoes in the coming week.

- For Iberian gas market the target price from the buyer are TTF forward price for September, which closed at equivalent of $5.22/MMBTU on Friday. However TTF plus 10 cents will be an acceptable price for suppliers, as it will attract US, West Africa, Norway and Trinidad cargoes.

- SW Europe prices heard at 15-20 cents premium with PEG Nord prices, and based upon $0.25-0.35/MMBTU re-gas charges, it translate into netback price of $5.10/MMBTI for Norway, $5.00/MMBTU for Nigeria and Trinidad and $4.89/MMBTU for US producers.

- Iberian gas prices still attractive for suppliers, as with re-gas cost (assumed) of $0.25-0.35/MMBTU, DES price is expected to be around $5.35-$5.45/MMBTU, as Gas Hub prices closed at €16.65/MWH (equivalent of $5.73/MMBTU) on Friday.

- US producers will focus on European market beside South American market as Los Romanes pipeline is expected to reduce demand for imported LNG in Mexico.

- Columbia receives its second shipment of 1.75 BCF at Cartagena, most probably a US origin cargo supplied by Vitol.

- Cameroon plans to export LNG Golar FLNG vessel, which will dock at the offshore of Cameroon’s Atlantic cost. This is a cost effective in comparison with building an on-shore based liquefaction infrastructure and will open up African gas reserves globally.

- Swan LNG Private limited has awarded EPC to Black & Veatch for FSRU based LNG import facility at Jafrabad, India. This is 5 MTPA project with 400-500 MMSCFD re-gasification capacity.

- Australian government will be concluding by 1st November 2017 about 2018 LNG export volumes, under the Australian Domestic Gas Security mechanism, each LNG exporter will be either granted un-restricted or restricted permission to export.

- Qatar is focusing on selling SPOT cargoes to Europe versus Egyptian market, as recently Qatar has turned down several requests by traders to supply to Egypt. Qatar is focusing more on European market for long-term basis, as Egypt may not be substantial LNG importing destination.

- Shell’s FLNG facility has arrived at it location, the Prelude field, Western Australia, the FLNG has 3.6 MTPA of LNG liquefaction capacity.

|

|

|

|

|

|

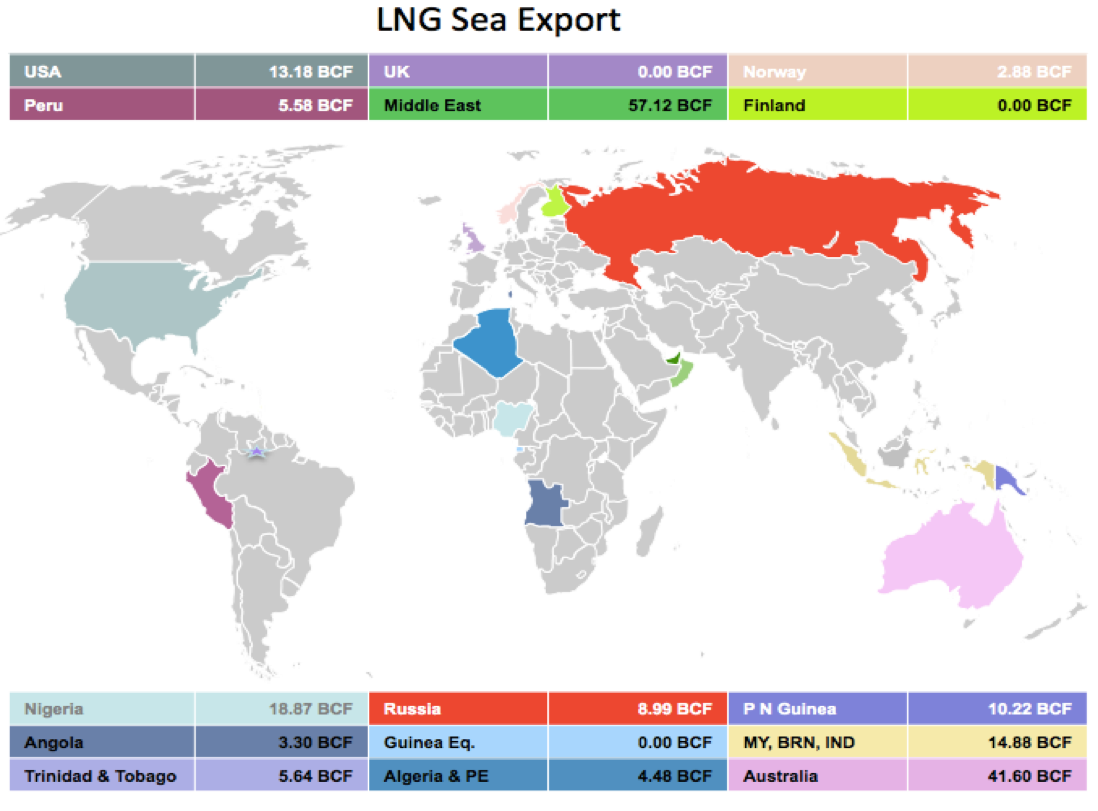

LNG Merchant Activity

- From Sunday 16th July till 21st July 2017, 41 vessels carrying 2.61 million tons (133.23 BCF) loaded from various supply centres

- 15 vessels carrying 1.13 millions tons, have been dispatched from Ras Laffan, Qatar.

- 3 vessels left for Indian ports while one left for Port Qasim Port, Pakistan, total volume dispatched 13.25 BCF.

- Four vessels carrying 12.36 BCF departed from Nigerian port for European, South American and Asian locations

- Algeria loaded one vessel carrying 1.53 BCF for France.

- Pont Fortin, Trinidad & Tobago loaded two vessels with 5.99 BCF.

- One vessel loaded from Brunei with load of 3.20 BCF.

- 6 vessels left from Australian export terminals of Dampier, Darwin and Gladstone ports for Japan, China, Korea and Singapore carrying 17.89

- One cargo left for France with 3.05 BCF from Norway.

- Middle Eastern terminals at Das Island (UAE), Qalhat (Oman) and Ras Laffan (Qatar) loaded 17 vessels carrying 63.55 BCF for Asian and European destinations.

| Departure Date | Vessel Name | Capacity(CBM) | Loading Port | Discharge Country | ETA Discharge Port | LNG (BCF) |

| 22-Jul-17 | LNG OYO | 142,988 | Bonny, Nigeria | Egypt | 16-Aug-17 | 2.95 |

| 23-Jul-17 | LNG PORT HARCOURT II | 170,000 | Bonny, Nigeria | Europe | 3.51 | |

| 23-Jul-17 | LNG IMO | 148,452 | Bonny, Nigeria | Europe | 3.06 | |

| 23-Jul-17 | LNG LOKOJA | 148,471 | Bonny, Nigeria | India | 17-Aug-17 | 3.06 |

| 27-Jul-17 | LNG KANO | 148,565 | Bonny, Nigeria | Japan | 10-Aug-17 | 3.07 |

| 27-Jul-17 | WILPRIDE | 156,007 | Bonny, Nigeria | Not Known | 27-Jul-17 | 3.22 |

| 28-Jul-17 | METHANE SHIRLEY ELISABETH | 142,800 | Punta Europa, Africa | Atlantic Basin | 09-Aug-17 | 2.95 |

| 27-Jul-17 | CHEIKH BOUAMAMA | 74,425 | Skikda, Algeria | Italy | 24-Jul-17 | 1.54 |

| 28-Jul-17 | COOL RUNNER | 160,000 | Soyo, Angola | Atlantic Basin | 05-Aug-17 | 3.30 |

| 22-Jul-17 | GALEA | 135,269 | Pampa Melchorita, Peru | Atlantic Basin | 2.79 | |

| 28-Jul-17 | GEMMATA | 135,269 | Pampa Melchorita, Peru | Not Known | 2.79 | |

| 22-Jul-17 | CATALUNYA SPIRIT | 135,423 | Point Fortin, Trinidad | Argentina | 04-Aug-17 | 2.79 |

| 27-Jul-17 | EXCALIBUR | 138,000 | Point Fortin, Trinidad | Colombia | 2.85 | |

| 23-Jul-17 | PROVALYS | 151,383 | Sabine Pass, USA | Chile | 3.12 | |

| 25-Jul-17 | OAK SPIRIT | 143,708 | Sabine Pass, USA | Mexico | 28-Jul-17 | 2.96 |

| 25-Jul-17 | SCF MELAMPUS | 170,200 | Sabine Pass, USA | Not Known | 28-Jul-17 | 3.51 |

| 23-Jul-17 | VALENCIA KNUTSEN | 173,400 | Sabine Pass, USA | Panama | 3.58 | |

| 25-Jul-17 | SERI AMANAH | 142,795 | Bintulu, Malaysia | Japan | 30-Jul-17 | 2.95 |

| 28-Jul-17 | SENSHU MARU | 125,835 | Bontang, Indonesia | Japan | 02-Aug-17 | 2.60 |

| 23-Jul-17 | PALU LNG | 159,800 | Bontang, Indonesia | Pacific Basin | 10-Aug-17 | 3.30 |

| 25-Jul-17 | PAPUA | 172,000 | Lese, Papua New Guinea | Japan | 2-Aug-17 | 3.55 |

| 23-Jul-17 | LNG JUPITER | 152,880 | Lese, Papua New Guinea | Japan | 07-Aug-17 | 3.15 |

| 28-Jul-17 | VELIKIY NOVGOROD | 170,471 | Lese, Papua New Guinea | Taiwan | 20-Jul-17 | 3.52 |

| 23-Jul-17 | NIZWA LNG | 145,469 | MIGAS LNG BATU, Indonesia | UAE | 15-Aug-17 | 3.00 |

| 28-Jul-17 | STENA BLUE SKY | 142,988 | Prigorodnoye, Russia | Japan | 02-Aug-17 | 2.95 |

| 25-Jul-17 | GRAND MEREYA | 145,964 | Prigorodnoye, Russia | Japan | 30-Jul-17 | 3.01 |

| 23-Jul-17 | OB RIVER | 146,791 | Prigorodnoye, Russia | Not Known | 3.03 | |

| 28-Jul-17 | ARKAT | 147,228 | Sieria Oil Terminal, Brunei | Not Known | 3.04 | |

| 22-Jul-17 | DAPENG MOON | 147,200 | Dampier, Australia | China | 29-Jul-17 | 3.04 |

| 25-Jul-17 | DAPENG SUN | 147,200 | Dampier, Australia | China | 04-Aug-17 | 3.04 |

| 24-Jul-17 | ENERGY HORIZON | 177,441 | Dampier, Australia | Japan | 30-Jul-17 | 3.66 |

| 22-Jul-17 | WOODSIDE DONALDSON | 162,620 | Dampier, Australia | Japan | 08-Aug-17 | 3.36 |

| 23-Jul-17 | FUJI LNG | 144,596 | Dampier, Australia | Pacific Basin | 02-Aug-17 | 2.98 |

| 26-Jul-17 | WOODSIDE CHANEY | 174,000 | Dampier, Australia | USA | 14-Aug-17 | 3.59 |

| 28-Jul-17 | ENERGY ADVANCE | 144,590 | Darwin, Australia | Japan | 02-Aug-17 | 2.98 |

| 23-Jul-17 | BW PAVILION VANDA | 161,880 | Gladstone, Australia | China | 05-Aug-17 | 3.34 |

| 22-Jul-17 | ARWA SPIRIT | 175,180 | Gladstone, Australia | China | 08-Aug-17 | 3.61 |

| 28-Jul-17 | CLEAN VISION | 162,000 | Gladstone, Australia | Japan | 2-Aug-17 | 3.34 |

| 25-Jul-17 | YK SOVEREIGN | 124,582 | Gladstone, Australia | Korea | 04-Aug-17 | 2.57 |

| 24-Jul-17 | METHANE RITA ANDREA | 145,000 | Gladstone, Australia | Pacific Basin | 06-Aug-17 | 2.99 |

| 24-Jul-17 | SERI BAKTI | 149,886 | Gladstone, Australia | Pacific Basin | 08-Aug-17 | 3.09 |

| 28-Jul-17 | ARCTIC DISCOVERER | 139,759 | Melokya, Norway | Portugal | 02-Aug-17 | 2.88 |

| 25-Jul-17 | MUBARAZ | 135,000 | Das, UAE | Japan | 08-Aug-17 | 2.79 |

| 28-Jul-17 | MARAN GAS ASCLEPIUS | 142,906 | Qalhat, Oman | Pakistan | 27-Jul-17 | 2.95 |

| 27-Jul-17 | AL BAHIYA | 205,981 | Ras Laffan, Qatar | China | 13-Aug-17 | 4.25 |

| 25-Jul-17 | BU SAMRA | 260,928 | Ras Laffan, Qatar | Far East | 5.38 | |

| 24-Jul-17 | DISHA | 136,026 | Ras Laffan, Qatar | India | 27-Jul-17 | 2.81 |

| 23-Jul-17 | ASEEM | 154,948 | Ras Laffan, Qatar | India | 28-Jul-17 | 3.20 |

| 27-Jul-17 | RAAHI | 138,077 | Ras Laffan, Qatar | India | 01-Aug-17 | 2.85 |

| 27-Jul-17 | AL ZUBARAH | 135,510 | Ras Laffan, Qatar | Japan | 10-Aug-17 | 2.80 |

| 23-Jul-17 | K.FREESIA | 138,015 | Ras Laffan, Qatar | Korea | 13-Aug-17 | 2.85 |

| 23-Jul-17 | SK SUNRISE | 135,505 | Ras Laffan, Qatar | Korea | 12-Aug-17 | 2.80 |

| 28-Jul-17 | BRITISH RUBY | 155,000 | Ras Laffan, Qatar | Mauritius | 02-Aug-17 | 3.20 |

| 28-Jul-17 | GOLAR CRYSTAL | 160,000 | Ras Laffan, Qatar | Mediterian | 3.30 | |

| 26-Jul-17 | WILFORCE | 155,900 | Ras Laffan, Qatar | Mediterian | 31-Jul-17 | 3.22 |

| 24-Jul-17 | AL DAAYEN | 148,853 | Ras Laffan, Qatar | Mediterian | 04-Aug-17 | 3.07 |

| 22-Jul-17 | AL JASSASIYA | 142,988 | Ras Laffan, Qatar | Pakistan | 30-Jul-17 | 2.95 |

| 25-Jul-17 | LUSAIL | 142,808 | Ras Laffan, Qatar | Taiwan | 13-Aug-17 | 2.95 |

| 22-Jul-17 | MILAHA RAS LAFFAN | 136199 | Ras Laffan, Qatar | Taiwan | 28-Jul-17 | 2.81 |

| 26-Jul-17 | EJNAN | 143,815 | Ras Laffan, Qatar | Taiwan | 11-Aug-17 | 2.97 |