Calculation reference for the Forward Price formula. Also, includes formulas for the Spot Rates & Forward Rates, Yield to Maturity, Forward Rate Agreement (FRA), Forward Contract and Forward Exchange Rates.

Short and sweet lessons in forward pricing

- Valuing a forward contract in Excel – Lesson Zero

- Forward Prices Calculation in Excel – Lesson 1

- Calculating Forward Prices and YTMS in Excel – Lesson 2

- Calculating Forward Foreign Exchange Rates in Excel – Lesson 3

- Defining the Par Interest Rate Term Structure

- Calculating the Zero interest rate curve

- Calculating the Forward interest rate curve

- Pricing or MTMing Interest Rate Swaps – IRS

- Pricing Basis swap

- Projecting Foreign Exchange Currency Rates for Cross Currency Swap Valuation (from CCS)

- CCS – Cross Currency Swap Valuation & Pricing

Forward Price formula

- Forward price of a security with no income

- The forward price of a security with known cash income

- The forward price of a security with known dividend yield

- Relationship between spot rates and forward rates-1

- Relationship between spot rates and forward rates-2

Forward Rate Agreement or FRA formula

- Value of a long forward contract (continuous)

- Value of a long forward contract (discrete)

- Price or value of a long forward contract (continuous) which provides a known income

- Value of a long forward contract (continuous) which provides a known yield

- Value of a forward foreign current contract (continuous)

1. Forward Price formula

a. The forward price of a security with no income

Where S0 is the spot price of the asset today

T is the time to maturity (in years)

r is the annual risk free rateof interest

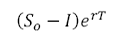

b. Forward price of a security with known cash income

(Securities such as stocks paying known dividends or coupon bearing bonds)

Where I is the present value of the cash income during the tenor of the contract discounted at the risk free rate.

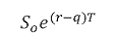

c. The forward price of a security with known dividend yield:

(Securities such as currencies and stock indices)

Where q is the dividend yield rate. For a foreign currency q will be the foreign risk free rate.

2. Spot Rates and Forward Rates

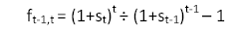

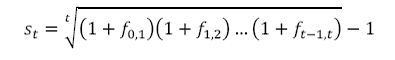

a. Relationship between spot rates and forward rates-1

b. Relationship between spot rates and forward rates-2

Where st is the t-period spot rate and

ft-1,t is the forward rate applicable for the period (t-1,t)

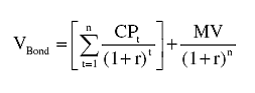

3. Yield to Maturity (YTM)

To solve for YTM we are solving for the interest rate (r) in the bond valuation formula:

Where CPt is the coupon payment at time t and MV is the maturity value at time n (i.e. at maturity).

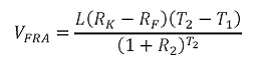

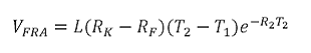

4. Forward Rate Agreement or FRA formula

The value of the FRA at time 0, VFRA, for someone receiving fixed and paying floating will be

if R2 (the zero coupon rate for a maturity of T2) is calculated on a discrete basis or

if R2 is calculated on a continuous basis.

Where, L is the principal amount

RK is the fixed interest rate

RF is the forward interest rate assuming that it will equal the realized benchmark or floating rate for the period between times T1 and T2

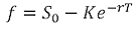

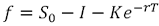

5. Forward Contract

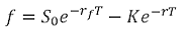

a. Price or value of a long forward contract (continuous)

Where S0is the spot price

T is the remaining time to maturity

r is the risk free rate

K is the delivery price which is set in the contract

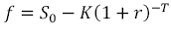

b. Value of a long forward contract (discrete)

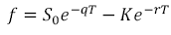

c. Price or value of a long forward contract (continuous) which provides a known income

I is the present value at time 0 of the known income on the investment assets

d. Value of a long forward contract (continuous) which provides a known yield

q is the know yield rate provided by the investment asset

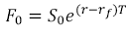

e. Price of a forward foreign current contract (continuous)

Where rf is the value of the foreign risk free interest rate when the money is invested for time T.

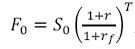

6. Forward exchange rates

Where r and rf are compounded continuously

or

if the interest rates were compounded on a discrete basis.

r is the risk free rate of the domestic currency

rf is the risk free rate of the foreign currency

Comments are closed.