Understanding Option Price Sensitivities – European Put Options – Sales & Trading Technical Interview Guides

As part of our Sales & Trading technical interview guide series we have done a number of posts on Greeks, Delta hedging and estimation of Delta hedging Profit & Loss.

A recent client/student/interview request indicated a preference/need for a sheet dedicated to European Put Options Greek plots. Hence the Greeks Put Option suspects’ gallery. While some of these are making a second appearance, we think a Put only collection is indeed useful given our focus on European Call options.

The Analysis framework used for dissecting put option Greeks is simple. We break the contracts down by “money-ness”. The three categories are Deep In, At/Near, Deep Out of money options.

And the five option pricing variables – Spot, Strike, Vol, Interest Rates & Time. This analytical combination produces interesting results.

The options for which Greeks have been plotted below assume a volatility of 20%, a risk free rate of 5% and a time to maturity of 1 year. In addition Spot and Strike prices are:

Deep In

Spot = 50

Strike = 100

At/Near

Spot = 50

Strike = 100

Deep Out

Spot = 50

Strike = 100

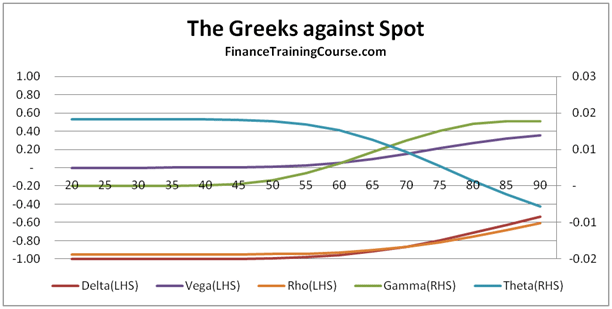

Greeks Against Spot – European Put Options

European Put Options – Deep In the money Options

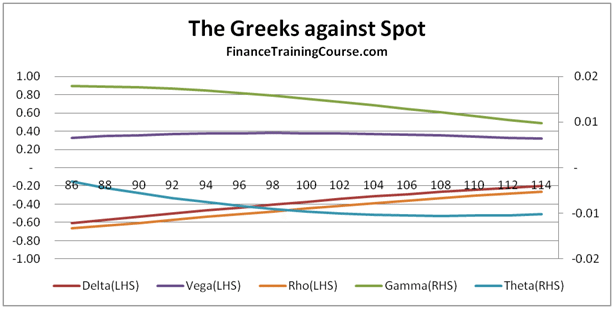

European Put Options – At/Near Money Options

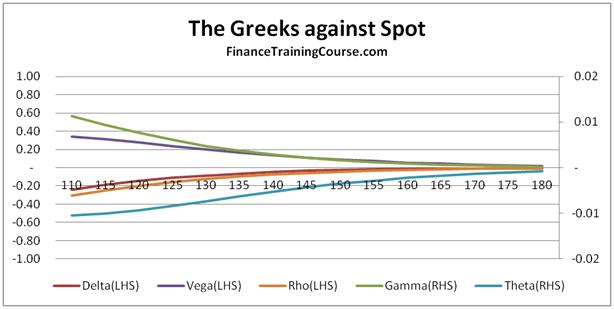

European Put Options – Deep Out of money Options

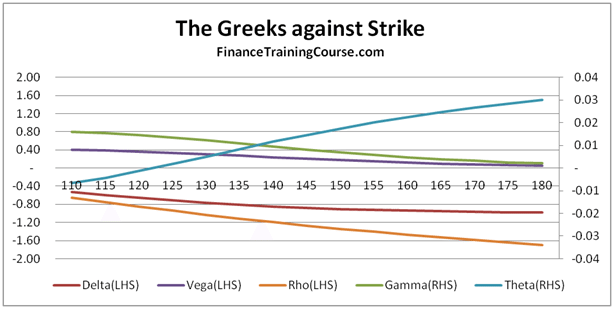

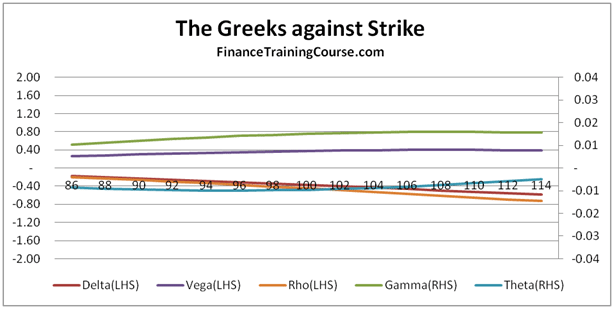

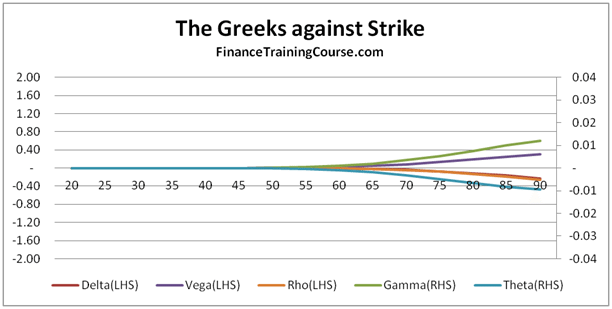

Greeks Against Spot – European Put Options

European Put Options – Deep In the money Options

European Put Options – At/Near money Options

European Put Options – Deep out of money Options

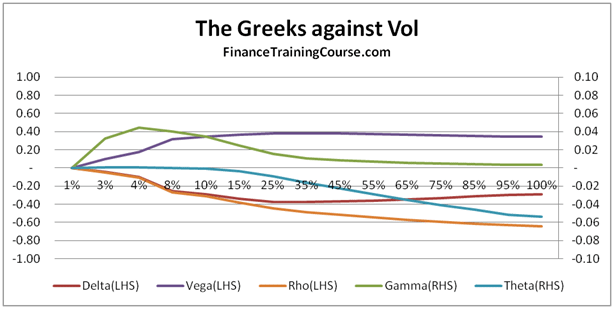

European Put Option Greeks – Against Volatility

European Put Options – At/In money Options

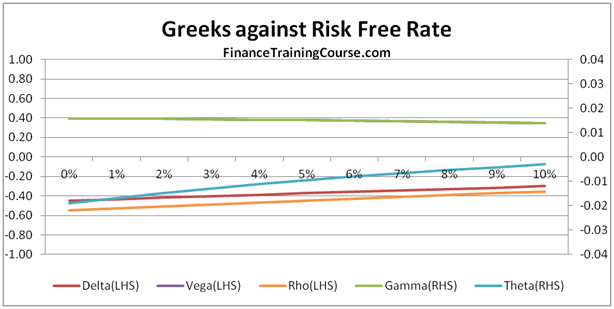

European Put Options – Against Changing Interest Rates

European Put Options – At/Near money Options

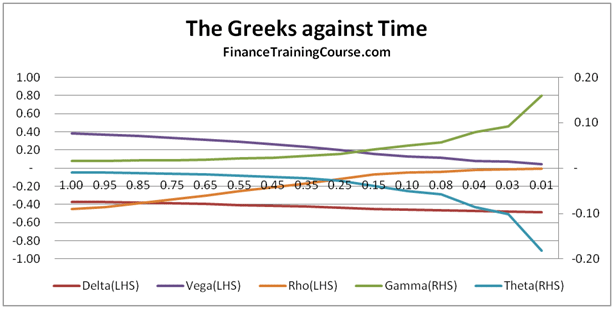

European Put Options – Against Changing Time to Maturity

European Put Options – At/Near money Options

Understanding Option Greeks – Relevant Sales & Trading Interview Guides prior posts

Understanding Greeks – Introduction

Understanding Greeks – Analyzing Delta & Gamma

Understanding Greeks – The Guide to delta hedging using Monte Carlo Simulation

Understanding Greeks – Quick Reference Guide to Delta, Gamma, Vega, Theta & Rho

Comments are closed.