CCAR

The Comprehensive Capital Analysis and Review or CCAR process is a US Federal Reserve supervisory program. It targets large active banking holding companies (>=$50 billion in total consolidated assets) domiciled in the US. The CCAR exercise, which began in 2011 and carried out once every year, is a qualitative and quantitative assessment of bank holding companies’ (BHC) capital position and planning strength & risk management processes. CCAR‘s primary objective is to avoid a repeat of 2008 financial crisis by giving regulators better and advance visibility into stress testing results of bank balance sheets on a regular basis.

CCAR process

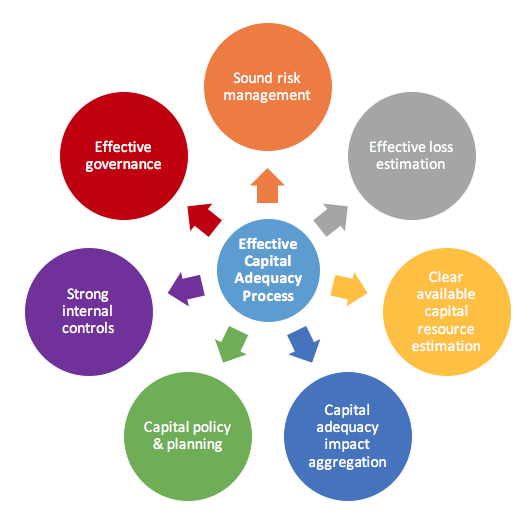

The process assesses:

- The entity’s capital adequacy on a forward looking basis. Over a nine-quarter planning horizon. Includes sources and uses of capital & the appropriateness of capital action plans (e.g. issuance, distributions, buy backs, etc.). In baseline and stressed scenarios.

- The resilience and forward looking capacity and quality of the entity’s internal capital adequacy assessment and planning processes. Such as an analysis of:

- All the risks present in its business and activities. Risk management practices (including the standardized and repeatable processes used by the BHC to identify, quantify, monitor and manage risks). And the degree of integration of these practices into the capital planning process.

- Firm specific (besides the supervisory) stress scenarios developed in light of the complexity and riskiness of its business model and portfolios.

- Internal governance (including reviews and challenges of the planning process by the board and senior management). And controls (including model & data quality, validation & review, documentation, internal audit) of its capital planning processes.

- The assumptions, methods and models used for estimating losses, revenues, expenses, capital, reserves, etc.

- The capital policy of the entity. That is, the principles and guidelines outlined and documented by the entity for its capital planning including goals, targets, triggers & contingency plans, and capital adequacy processes and practices.

The Fed uses its own forecasting models for balance sheet and risk weighted assets projections of the BHCs, rather than solely relying on the BHC’s own model results to verify the capital strength of the entity under the stressed scenarios.

Dodd Frank Act Stress Tests & CCAR

In addition to this assessment, the Federal Reserve requires banks to perform stress tests under the Dodd Frank Act Stress Tests (DFAST). A requirement by the Federal Reserve since 2009. While CCAR and DFAST stress tests are complimentary in that they make use of similar “processes, data, supervisory exercises and requirement”, they differ in the assumption used for future capital actions during the planning horizon. For CCAR the entity uses its own capital action assumptions. Whereas for DFAST all entities use a standardized set of capital actions.

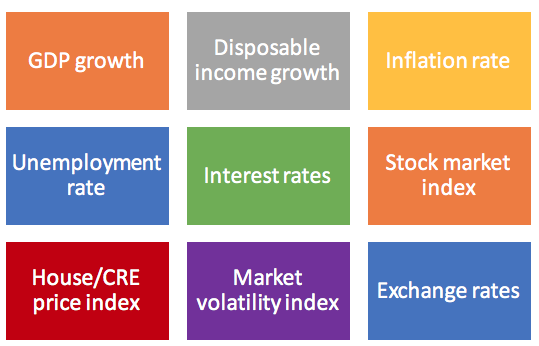

Annual supervisory DFASTs use hypothetical economic and financial market scenarios with assumptions specified by the Fed. Mid-term DFASTs use firm specific assumptions instead for the tests. The DFASTs aim to ensure that the banking entity will have adequate capital to absorb losses. Thus, allowing for continued operations (including its ability to lend) during periods of economic stress. The scenarios represent baseline, adverse and severely adverse scenarios.

Minimum regulatory capital requirement

CCAR includes an assessment of the entity’s capital adequacy for current as well as supervisory and BHC baseline & stressed scenarios. This includes the calculation of the minimum regulatory capital ratios. Effective 1 June 2015 revisions to the minimum regulatory capital definitions conform to the BCBS’ Basel III requirements keeping in mind the requirements of the Dodd-Frank Act (e.g. restrictions on the use of credit ratings).

Note: the minimum capital adequacy requirement applies to all banks not just large banks

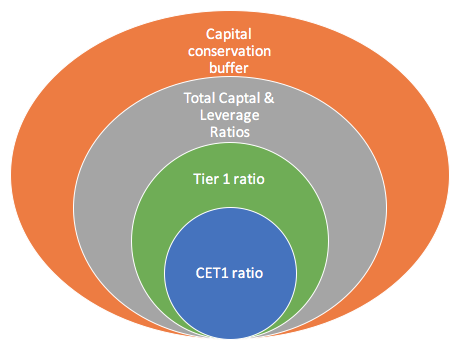

The minimum regulatory requirements include:

- a common equity tier 1 (CET1) ratio of 4.5%,

- a minimum tier 1 capital ratio of 6%

- a total capital (considering both tier 1 & tier 2 capital) ratio of 8%

- a leverage ratio of 4%

- a supplementary tier 1 leverage ratio (for banks approved for the advanced approaches) of 3%

- a capital conservation buffer of 2.5%. If a bank violates this buffer it faces restrictions to its capital distributions.

- a countercyclical capital buffer for banks approved for the advanced approaches

The Fed’s prompt corrective action framework incorporates triggers based on these revised requirements.

Liquidity Coverage Ratio

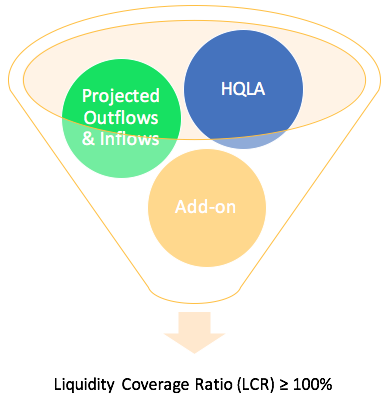

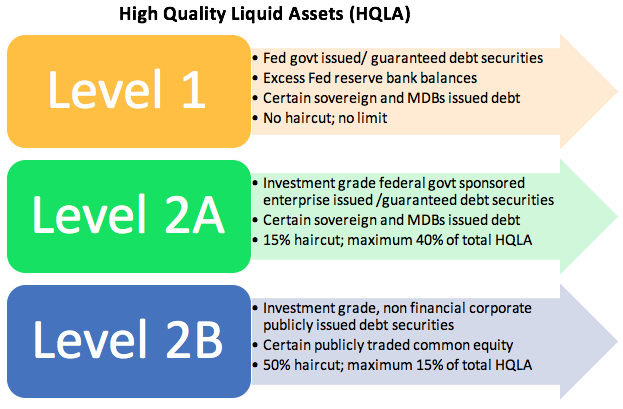

In addition to meeting the revised Basel III minimum capital adequacy requirement, large internationally active banking entities (≥$250 billion in total consolidated assets and $10 billion in foreign exchange exposure) are also required to calculate a liquidity coverage ratio (LCR) on a daily basis. This ensures that the BHC’s will hold at least a minimum amount of liquid assets to provide for short term liquidity needs. The measure was created to avoid the poor liquidity management situation witnessed in many banking institutions during the financial crisis.

The US implementation of the ratio is in line with BCBS’ Basel III requirement with the following exception. It includes an add-on to account for liquidity stresses and cash flow volatility within the stipulated 30-day period as part of the denominator.

The regulation’s ‘phase in’ state began 1 January 2015 and should be fully implemented by 2017.

As of the writing of this post the Fed was still finalizing the Net Stable Funding Ratio (NSFR), the supplemental Basel III longer term minimum liquidity/ stable funding requirement regulation. As of July 2016 a notice of proposed rule making was published by the Federal Reserve for public comment on the calibration of the NSFR.

In upcoming posts we discuss each of these sections, in particular US implementation of Basel III requirements, in more detail.