Options (or Derivatives in general) are instruments whose payoffs depend on the movement of underlying assets. The value of the derivative instrument, therefore, can be evaluated by creating and valuing a portfolio of assets whose prices are easily observed in the market and whose cash flows replicate those of the options.

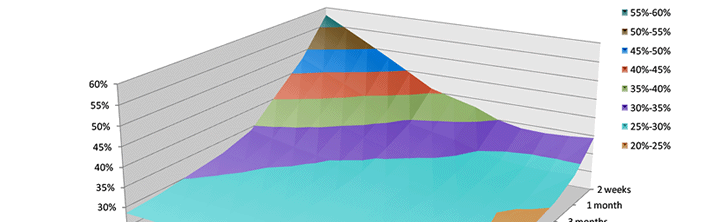

The methodologies used to price a derivative security may vary from closed form solutions such as the Black-Scholes option pricing formula, to numerical methods such as the binomial trees and Monte Carlo simulation.

Our Option pricing guides cover vanilla options, exotics, interest rate derivatives & cross currency swaps. We use Monte Carlo Simulation for exotics, Black Scholes for intuition, Binomial trees for American options & forward and zero curves for interest rate derivatives

- How to calculate the value of a forward contract in Excel

- How to calculate the forward price of a security in Excel

- How to determine Spot Rates and Forward Rates & Yield to Maturity

- How to calculate the values of Forward Rate Agreements (FRA) and Forward Exchange Rates

- Simulation Models – Pricing Ladder Options using Monte Carlo Simulations

- Pricing Exotic Options using Monte Carlo Simulations

- Understanding delta hedging for options

- Derivatives Crash Course for Dummies

- Derivative Pricing, Risk Management, Financial Engineering – Equation Reference

- Options pricing with Binomial trees in Excel spreadsheets

- Pricing Interest Rate Swaps – The valuation and MTM course

- Interest Rate Options – Pricing Caps and Floors

- Computational Finance: Building Monte Carlo (MC) Simulators in Excel

- Monte Carlo Simulation – How to reference

- Convergence and Variance Reduction procedures for option pricing models

- War on Greeks. The weekend Option pricing challenge

- Selling derivative products to treasury customers

- The Option Pricing models 5 nights crash course

- Option Pricing course guide for dummies

Recent Posts

- Estimate Total Addressable Market Size. A case study

- Pakistan retail trade sector size? A lazy data case study

- Estimate Market Size – Sizing Pakistan’s ecommerce market

- The 10 minute Financial Modelling quick reference guide

- Blue Ex: A Third-Party Logistics Valuation Case study

- Crypto Risk Review and Assessment – a Framework

- Price to Sales & Valuation

- Modelling RSU expense in EXCEL

- Rationality is overrated. The short and sweet edition.

- Financial Modeling Lessons for startups.

Premium Courses:

- Derivatives Terminology Crash Course

- Derivative Products

- Derivative Products – Package

- Derivative Pricing – Binomial Trees EXCEL Example

- Derivative Pricing – Binomial Trees – Efficient Approach

- Forward Prices, Forward Rates and Forward Rate Agreements (FRA) – EXCEL Example

- Forward Prices and Forward Rates – Calculation reference & detailed examples

- Forward Prices, Spot Rates & Forward Rates, Yield-to-Maturity, Forward Rate Agreements (FRA), Forward Contracts and Forward Exchange Rates

- Monte Carlo Simulation – Equity – Example

- Monte Carlo Simulation – Commodity – Example

- Monte Carlo Simulation – Currency – Example

- Monte Carlo Simulation – Package

- Monte Carlo Simulator with Historical Returns

- Pricing IRS – Module I – Term Structures

- Pricing IRS – Module I – Term Structures EXCEL Example

- Pricing IRS – Module II – IRS and CCS

- Pricing IRS – Module II – IRS and CCS EXCEL Example

- Pricing Interest Rate Options – Module III

- Pricing Interest Rate Options – Module III EXCEL Example

- Pricing Ladder Options using a Monte Carlo Simulator

- Pricing Interest Rate Swaps and Interest Rate Options – Package

- Valuing Options – Black Scholes Example

- Valuing Options – Binomial Tree – Traditional Approach – EXCEL Example

Comments are closed.